KATHMANDU: Despite the Nepal Bankers Association (NBA), the representative body of CEOs of Class ‘A’ banks, officially discontinuing the interest rate cartel one month ago, interest rates published by the banks for the month of Bhadra (mid-August to mid-September) indicate that some institutions are still engaging in collusion to fix interest rates.

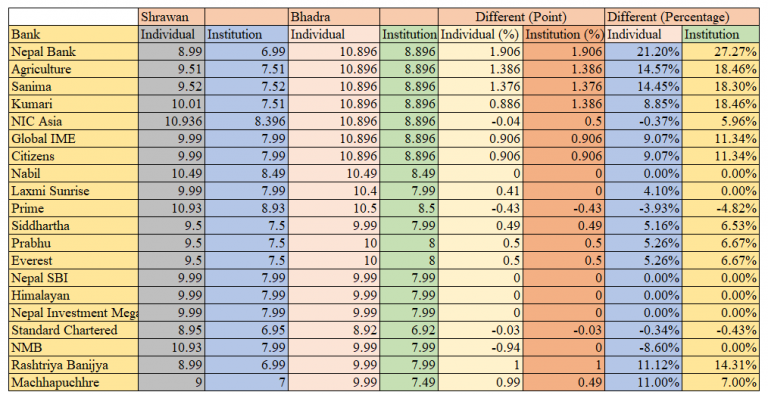

Seven commercial banks have set identical interest rates for the second month of the current fiscal year 2023/24. Nepal Bank Ltd, Agricultural Development Bank Ltd (ADBL), Sanima Bank Ltd, Kumari Bank Ltd, NIC Asia Bank Ltd, Global IME Bank Ltd, and Citizens Bank International Ltd have all fixed the interest rate for individual fixed deposits at 10.896%. These banks also have a uniform interest rate of 8.896% for institutional fixed deposits.

These banks had fixed different rates for the month of Shrawan (mid-July to mid-August), Nepal Bank had implemented a rate of 8.99% for individual fixed deposits, while ADBL had set its rate at 9.51%. Similarly, Sanima Bank and Kumari Bank offered interest rates of 9.52% and 10.01%, respectively. While NIC Asia Bank offered an interest rate of 10.936%, Citizens Bank International had fixed the rate at 9.99%.

Siddhartha Bank, Nepal SBI Bank, Himalayan Bank, Nepal Investment Bank Mega, NMB Bank, Rastriya Banijya Bank, and Machhapuchhre Bank have also offered the same interest rate of 9.99% for individual fixed deposits for the month of Bhadra.

Seven commercial banks have set identical interest rates for the second month of the current fiscal year 2023/24.

According to rates published by the commercial banks, 12 banks have elected to raise their interest rates, whereas four banks have opted to maintain their existing rates. Nabil Bank has continued its rate of 10.49% for the month of Bhadra as well. Likewise, Nepal SBI Bank, Himalayan Bank, and Nepal Investment Bank Mega have chosen to continue with an unchanged interest rate of 9.99% for the second month of the fiscal year.

Laxmi Sunrise Bank has made an upward adjustment of 0.41 percentage points to its interest rate, while Prime Commercial Bank has slightly reduced its rate from 10.93% to 10.5%. Siddharth Bank has similarly revised its rates from 9.99% to 9.5%. Prabhu Bank and Everest Bank have both made upward adjustments of 0.5 percentage points, bringing their rates to an even 10% each.

More:

NBA discards interest rate cartel; banks free to fix rates on their own

![International Industrial Trade Fair underway in Kathmandu [In Pictures]](https://en.himalpress.com/wp-content/uploads/2024/05/mela-2.jpg)