Source: ADB

Source: ADB

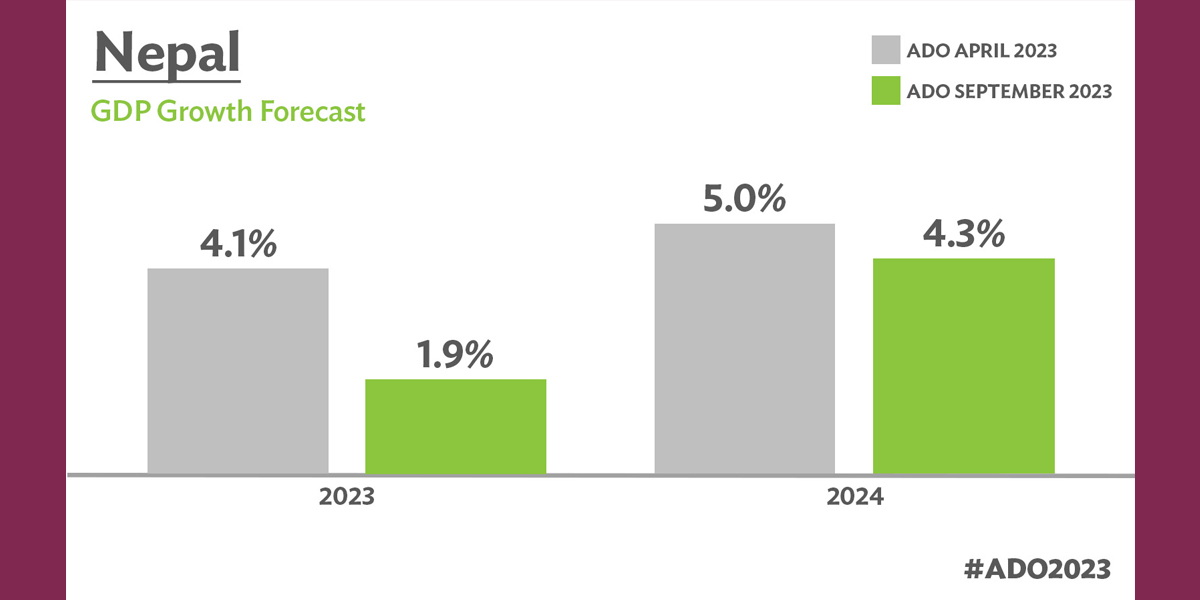

KATHMANDU: The Asian Development Bank (ADB) has anticipated Nepal’s economy to grow by 4.3% (at market prices) in the current fiscal year, up from an estimated 1.9% in the previous fiscal year.

“With moderation in inflation and comfortable foreign exchange reserves, the Nepal Rastra Bank (central bank) adjusted its monetary policy stance by lowering the policy rate by 50 basis points to 6.5%, which is expected to help lower commercial interest rates and stimulate economic activities,” the September edition of the ADB’s flagship publication – the Asian Development Outlook (ADO) – states. “Services are expected to perform well with expansions coming from real estate, wholesale and retail trade and accommodation and food services. Agriculture growth may however decelerate owing to deficient rainfall in June and erratic weather patterns, further aggravated by lumpy skin outbreak in cattle.”

The report projects annual average inflation to fall to 6.2% in the current fiscal year from 7.7% in the previous fiscal year on subdued oil price increases and a decline in inflation in India, Nepal’s main source of import, the ADB said quoting the report.

“Despite some progress in restoring price and external sector stability, fiscal challenges persist. While the estimated fiscal deficit for the current fiscal year is expected to moderate to 2.4% of GDP, much lower than the deficit of 6.1% in FY2023, the actual deficit could be substantially higher if the government does not meet its ambitious revenue target,” the ADB said, quoting Jan Hansen, its Principal Economist for Nepal.

According to the report, external risks remain relatively well contained. “Considering the recent trends and the central bank’s prudent monetary policy stance, the target of maintaining foreign exchange reserves sufficient to sustain at least 7 months of imports seems achievable. Amid stable remittances and higher imports, the current account deficit is expected to widen to 1.8% of GDP as growth revives in FY2024,” it added.

ADB has cautioned that the downside risks to the economic outlook in the current fiscal year may arise from more contractionary economic policy by the authorities to stem price rises given the uncertainties centered around geopolitical tensions.

Himal Press

Himal Press