KATHMANDU: A study by the Financial Information Unit (FIU) under the Nepal Rastra Bank (NRB) has found a steady rise in suspicious financial activities linked to virtual assets (VAs), indicating that restrictive measures alone have failed to curb associated risks.

Virtual assets refer to digital representations of value that can be digitally traded, transferred, or used for payment or investment purposes. This excludes digital representations of fiat currencies, securities, or other traditional financial assets already covered by existing regulations.

According to the Strategic Analysis Report 2025 published by the FIU, the number of Suspicious Transaction Reports and Suspicious Activity Reports (STRs/SARs) related to virtual assets has shown an overall upward trend over the past five years. Only 13 such reports were filed in 2021, but the number surged to 173 in 2022. It declined slightly to 138 in 2023 before rising sharply again to 252 in 2024. As of July 16, 2025, 82 VA-related STRs/SARs have been reported.

The FIU is the central agency established to combat money laundering (ML), terrorist financing (TF), and proliferation financing (PF) by receiving, analyzing, and disseminating financial intelligence to law enforcement for investigation and action.

The number of Suspicious Transaction Reports and Suspicious Activity Reports (STRs/SARs) related to virtual assets has shown an overall upward trend over the past five years.

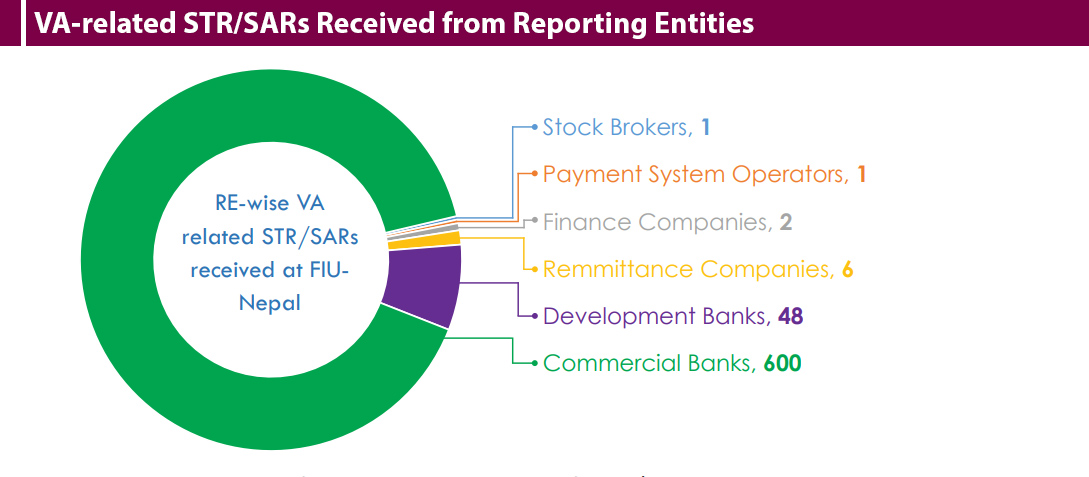

The report shows that commercial banks account for an overwhelming 91.19% of all VA-related STRs/SARs. The central bank has attributed this largely to the use of bank accounts for virtual asset-related activities, including receiving returns on investment. The integration of all commercial banks into the goAML system and the strengthening of suspicious transaction reporting mechanisms have also contributed to higher reporting levels, it added.

Most of the reported cases have been disseminated to the Nepal Police, followed by the Department of Revenue Investigation. Only six cases have so far been forwarded to the Department of Money Laundering Investigation. While many cases raised suspicion over the use of virtual assets, only a limited number could be directly linked to money laundering through such assets, the FIU said in its report.

The FIU identified several key typologies associated with virtual asset-related activities. Some of them include illegal foreign exchange transactions, hundi operations, online fraud, cryptocurrency trading disguised as legitimate business activities, and the use of money mules—often involving bank accounts of family members and relatives.

According to the report, around 75% of individuals suspected of VA-related activities fall within the 21–35 age group. Students make up 29% of suspects, followed by salaried employees at 21%. The FIU has warned in the report that this digitally adept but financially vulnerable group is disproportionately targeted by online investment scams and “get-rich-quick” schemes.

Most VA-related STRs/SARs are triggered by ongoing transaction monitoring conducted by banks and financial institutions, as well as information received through informal channels such as emails and screenshots showing customer accounts linked to virtual asset applications like Binance. Other drivers include direct inquiries from law enforcement agencies and intelligence obtained from walk-in customers.

The report states that there are several cases where money mules were unaware that their bank accounts were being used for prohibited virtual asset activities. “In some instances, individuals misused dollar cards to purchase cryptocurrencies, while others scammed victims by persuading them to transfer funds with promises of high returns through crypto or bitcoin investments,” it added.

Despite a ban onsuch activities, the continued filing of STRs/SARs and investigation of such cases suggest that control measures are being evaded. As Nepal is in an early phase of digitization and technological adoption, the use of virtual assets is increasingly intertwined with other predicate offences such as digital fraud, investment scams, online gambling, and hundi, making the sector more vulnerable to money laundering, terrorist financing, and proliferation financing risks.

“The persistent rise in VA-related STRs, despite the prohibition, indicates that a total ban alone is insufficient,” the report states, suggesting that the government may need to shift towards enhanced detection, investigation, and public awareness strategies to manage risks that are increasingly operating within the informal and illicit economy.

Himal Press

Himal Press