KATHMANDU: Nepal Rastra Bank (NRB) Governor Maha Prasad Adhikari has stated that the Monetary Policy for the current fiscal year has been formulated after a thorough assessment of the overall state of the economy.

Speaking at a discussion program on monetary policy, Governor Adhikari said that while most central banks around the world are adopting strict policies, NRB has opted for a flexible approach.

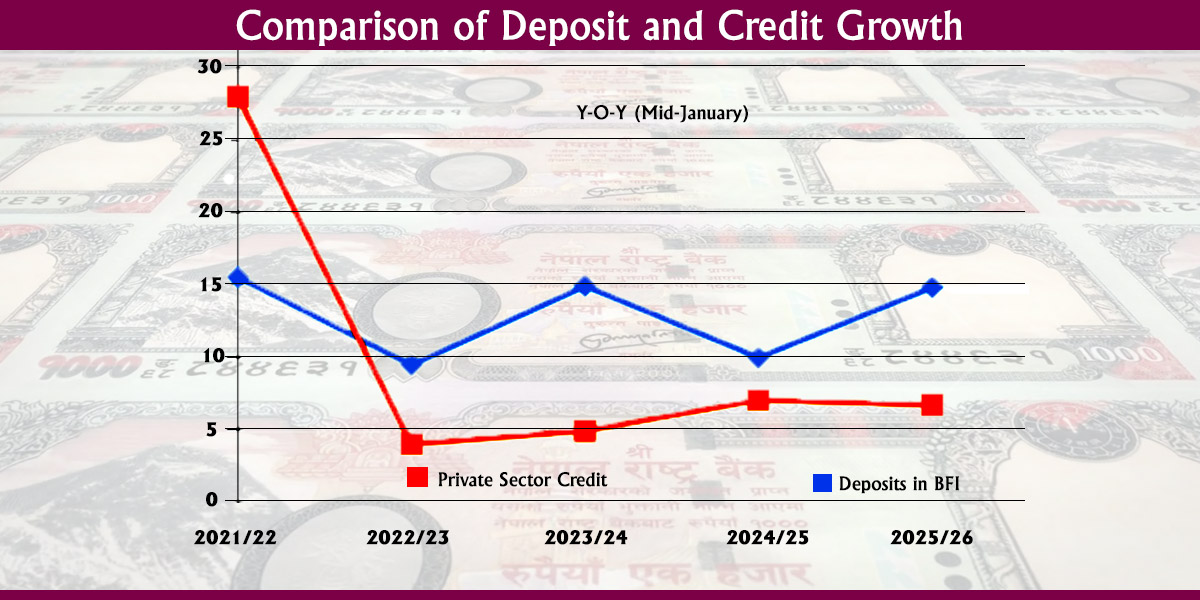

“We have reduced the policy rate to 6.5% from 7%. The external sector also appears to be more favorable. The central bank made this decision after observing that the liquidity situation has improved,” Adhikari said. “The target for private sector credit growth has been set at 11.5%, and the overall economic growth rate has been targeted at 6.5%. The monetary policy has been crafted with the aim of containing inflation within the specified limits.”

Governor Adhikari clarified that the targets for private credit growth rate and inflation were not ambitious but were based on a thorough analysis of monetary indicators. “These targets were set considering the easing liquidity situation, declining interest rates, the status of remittance inflows, and programs aimed at improving the state of government budget expenditure,” he explained.

In the previous financial year, the central bank had projected private sector credit to grow by 12.5%, but it was limited to 3%. The central bank has attributed the slow credit expansion in the previous fiscal year to factors such as sluggish capital spending, low economic growth, and a tight liquidity situation.

The central bank has also noted that the credit expansion suffered due to the government’s inability to spend capital as anticipated, the low economic growth rate, and liquidity contraction.

Himal Press

Himal Press