KATHMANDU: Nepal Rastra Bank (NRB) has given continuity to the policy provisions introduced in the monetary policy, stating that most of the economic indicators are encouraging.

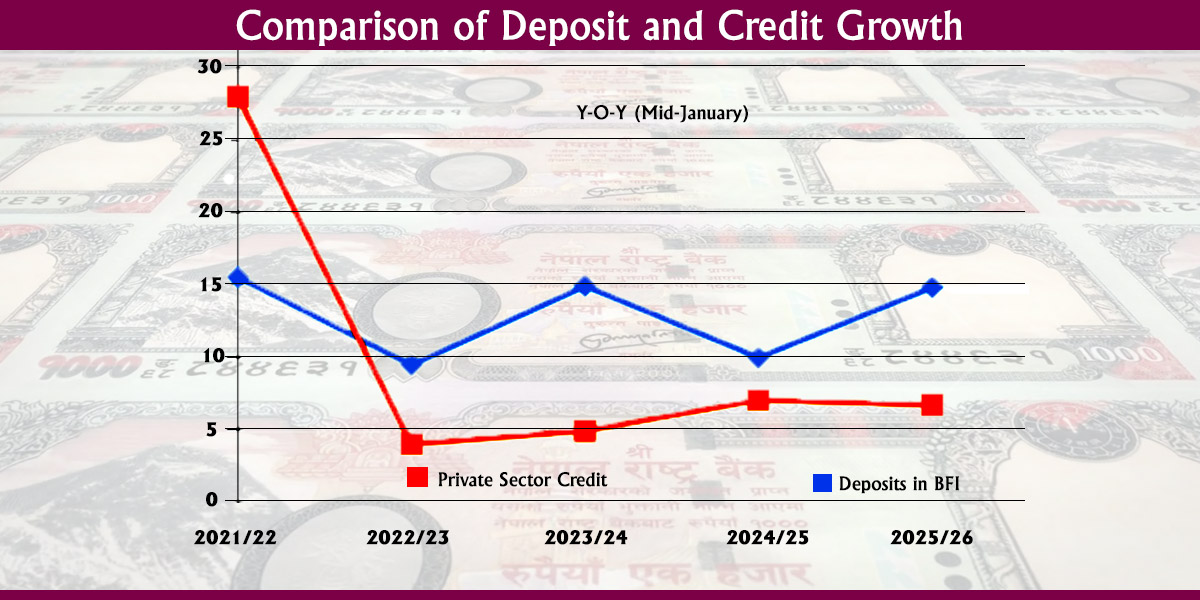

Releasing its midterm review of the monetary policy for the current fiscal year on Friday, the central bank said interest rate is decreasing, liquidity situation is improving, inflation is moderating and the balance of payment situation is improving.

The NRB has hoped that capital expenditure by federal and province governments and the improving financial situation will have a positive impact on the national economy.

Despite painting a rosy picture of the economy, the central bank has warned that the economy is still not free of risks. The central bank has said that future activities will determine whether the current positive indicators will be sustainable.

The central bank took a policy of tightening imports from December last year after the economy started facing external sector pressure. It introduced a provision of 50 to 100% cash margin on imports. In line with the policy taken by the central bank, the government also put a ban on the import of certain goods. This helped check the depletion of foreign currency reserves and bring down imports to some extent. However, there is a risk of imports ballooning again given our consumption pattern, the central bank has noted.

According to the central bank, the rising public debt has become a matter of concern. Public debt has gone up by 23.9% over the past five years, while domestic debt has gone up by 27.3%. Total public debt is about 41.5% of the country’s total GDP. The central bank warned that the cost of internal debt mobilization will increase and it may have a long-term impact on interest rates, liquidity position and inflation.

The central bank has also seen the recent forecast of economic contraction as another possible challenge for the economy. The International Monetary Fund (IMF) has predicted that global trade will shrink by 2.4% in 2023 and expand by 3.4% in 2024.

Himal Press

Himal Press