This combo image shows (from left) CNI President Rajesh Agrawal, FNCCI President Chandra Prasad Dhakal and NCC President Rajendra Malla.

This combo image shows (from left) CNI President Rajesh Agrawal, FNCCI President Chandra Prasad Dhakal and NCC President Rajendra Malla.

KATHMANDU: The private sector has commented that the monetary policy of the current financial year 2023/24 cannot solve the problems that the economy is facing.

Three business organizations of the private sector – Federation of Nepalese Chambers of Commerce and Industry (FNCCI), Confederation of Nepalese Industries (CNI) and Nepal Chamber of Commerce (NCC) – Monday issued a joint statement and said that the monetary policy cannot lift the economy from recession.

Nepal Rastra Bank (NRB) unveiled the Monetary Policy for Fiscal Year 2023/24 on Sunday.

“The private sector was expecting a monetary policy that can deal with the existing challenges of the economy like high-interest rates, low demand, cash flow problems, low production, job cuts, declining confidence of the private sector, and postponement of new investment plans. However, the policy taken by the central bank through the monetary policy does not seem to be helping to lift the economy out of recession,” they said in the statement.

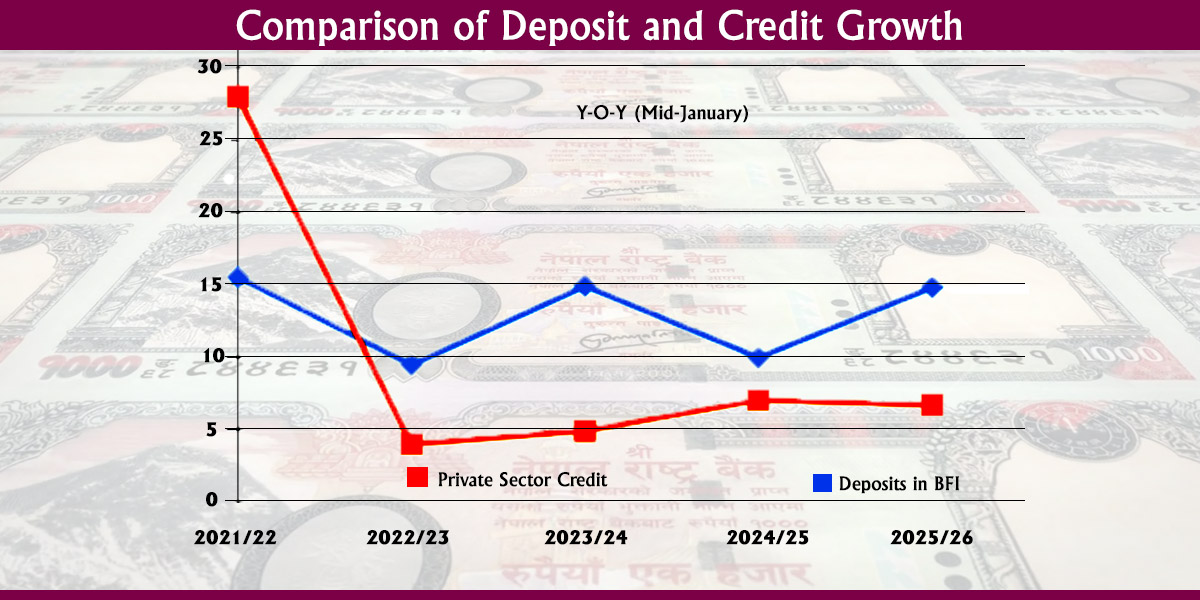

The monetary policy of the previous fiscal year had set a target of increasing private sector credit by 12.6%, this target has been reduced to 11.5% for the current fiscal year, they added. “This way it will be difficult to achieve the economic growth target of 6% taken in the budget,” the statement said.

The central bank has reduced the policy rate by 0.5 percentage points while keeping the bank rate unchanged. The private sector says that this will not help to bring down lending rates.

The three private sector organizations have also suggested to the central bank to use all monetary tools to reduce the base rate of the banks.

“The private sector’s suggestions like bringing down loan provisioning to 1% from existing 1.3% for good loans, loan restructuring and rescheduling for borrowers hit by falling demand as per consensus between banks and borrowers, and low premium on interest rate went unheard,” the statement read.

Stating that the central bank has said that it would review the working capital loans guidelines, the three bodies of the Nepali private sector said banks and borrowers should be allowed to take decisions on it.

The private sector seems to be suspicious of the central bank’s plan to issue a separate guideline for the supervision of large borrowers.

The three organizations, however, have welcomed the decision to raise the lending limit for the first residential house to Rs 20 million from Rs 15 million, the US dollar exchange facility for foreign visits to $2,500 twice a year from $ 1,500, and reduce capital adequacy ratio for margin lending, real estate loans and hire purchase loans.

Himal Press

Himal Press