KATHMANDU: The Nepal Rastra Bank (NRB) has unveiled the first quarterly review of the Monetary Policy for the fiscal year 2023/24, introducing several significant changes aimed at enhancing fiscal and monetary stability.

The central bank’s strategic adjustments reflect a nuanced approach to economic conditions and a commitment to fostering a favorable financial environment.

Here are the key highlights from the recent monetary policy review:

1. Liquidity Management: Banks have utilized Rs 239.49 billion in liquidity from the central bank, contributing to a 58.67% surge in interbank transactions. This rise suggests a more relaxed liquidity situation in the banking sector.

2. Interest Rate Adjustments: Both short-term and long-term interest rates witnessed a decline in the first quarter. The weighted average interest rate on 91-day treasury bills plummeted from 10.14% to 4.94%, while the interbank transaction interest rate dropped from 8.51% to 2.26%.

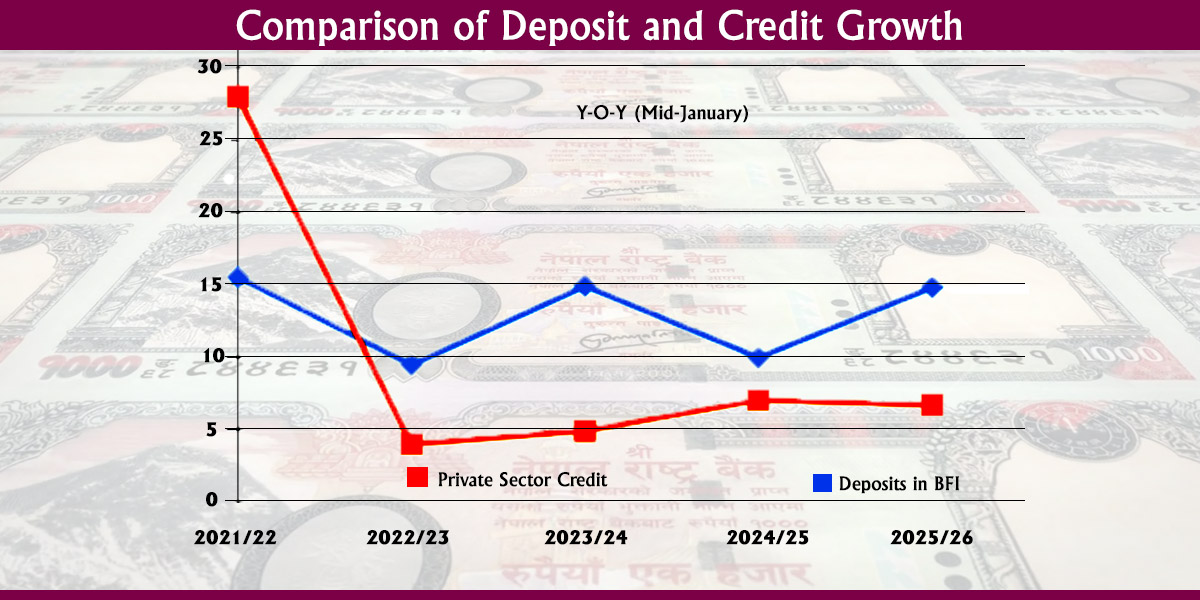

3. Loans and Deposit Growth: Private sector loans experienced a moderate growth of 4.8%, a slight decline compared to the previous year. In contrast, deposit growth surged impressively by 14.9%, indicating robust liquidity in the banking system. The central bank has anticipated improved credit expansion as interest rates continue to decrease.

4. Risk Weight Adjustment: The risk weight for real estate and margin loans exceeding Rs 5 million has been reduced to 125%, providing some relief to borrowers.

5. Monthly Installment Ratio for Housing Loans: The monthly installment income ratio for housing loans up to Rs 50 million has been increased and maintained at 60%, potentially easing the burden on borrowers.

6. Loan Restructuring for Microfinance Borrowers: Borrowers in contact with microfinance institutions facing difficulties in servicing their loans are eligible to apply for loan restructuring until mid-April 2024.

7. Policy Rate Changes: The bank loan rate decreased from 7.5% to 7%, the policy interest rate was lowered from 6.5% to 5.5%, and the deposit collection policy rate was maintained at 3.0%.

8. BFIs’ Debentures: Bank and Financial Institutions’ (BFIs) debentures will be considered 100% as resources until mid-January 2024, after which they will be considered 50% until mid-July 2024.

9. Government Fiscal Indicators: Government expenditure increased by 0.9%, while revenue mobilization saw a growth of 5%. Total expenditure reached Rs. 280.57 billion, constituting 16% of the fiscal year’s allocation.

10. Debt Management: The government has raised Rs. 106.79 billion in the first three months, comprising internal debt of Rs. 97.31 billion and external debt of Rs. 9.48 billion. This is 23.6% of the amount that the government has targeted to raise in the current fiscal year.

11. Earthquake Response Measures: In response to the earthquake in Karnali Province in November, the loan limit for affected individuals has been raised to Rs. 2.5 million. Banks cannot add more than a 2% premium on the base rate on such loans.

Himal Press

Himal Press