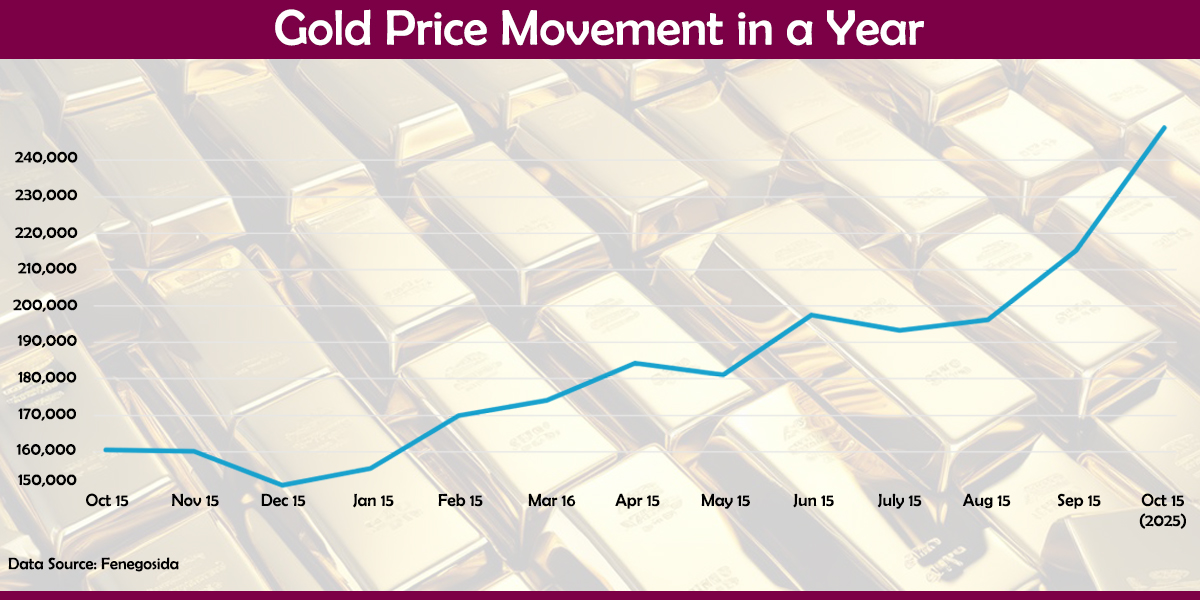

KATHMANDU: Gold prices in the domestic market surged to an all-time high of Rs 248,900 per tola (11.664 grams) on Wednesday, marking a 55.07% increase over the past year. The yellow metal was traded at Rs 160,500 per tola on the same day last year, meaning gold has become Rs 88,400 per tola dearer in the past 12 months.

Gold has also risen sharply since the Dashain holidays, recording an 11.51% jump from Rs 223,300 per tola on September 28. Within just over two weeks, gold prices have increased by more than Rs 25,000 per tola. This reflects sustained upward momentum in both domestic and international bullion markets.

The recent rally has been particularly swift. Gold first crossed the Rs 200,000 mark in the domestic market on August 29, posting an overnight gain of Rs 1,200 per tola. It climbed past Rs 210,000 on September 5, trading at Rs 210,400 per tola, and again breached Rs 220,000 on September 23 after a single-day rise of Rs 3,900 per tola. On Tuesday, prices jumped Rs 8,100 per tola, reaching Rs 248,500 — one of the largest overnight increases in recent times.

The sharp escalation in domestic prices mirrors global trends. In the international market, gold breached $4,200 per troy ounce for the first time on Wednesday. The surge is attributed to mounting demand from central banks and investors seeking safe-haven assets amid economic uncertainty. Analysts say fears of a global slowdown have prompted investors to shift funds from riskier assets such as equities to gold. This has pushed up the prices of the yellow metal.

Bank of America Global Research on Monday raised its 2026 outlook for gold to $5,000 per ounce, forecasting that a 14% increase in investment demand could drive the price higher over the next two years.

Since Nepal relies entirely on imports to meet its gold demand, fluctuations in the international market and exchange rates have a direct impact on domestic prices.

According to Arjun Rasaili, President of the Federation of Nepal Gold and Silver Dealers’ Association (Fenegosida), the price rally is unlikely to subside soon. “The upward trend in gold prices is expected to continue in the near term and could reach Rs 265,000 per tola,” he said. “Whether prices stabilize or decline later will depend largely on international market conditions.”

Rasaili added that geopolitical tensions and recent policy moves by the United States have influenced the market. “After the US imposed a 100% tariff on Chinese goods, gold prices shot up. Unless the US adopts a more flexible trade and foreign policy, prices are unlikely to fall immediately,” he added.

He further said that major economies — including China, Russia, Turkey, Poland and India — have been purchasing large quantities of gold to diversify reserves and reduce dependence on the US dollar. This, according to Rasaili, has contributed to supply constraints and an uptick in prices in the global market.

Himal Press

Himal Press