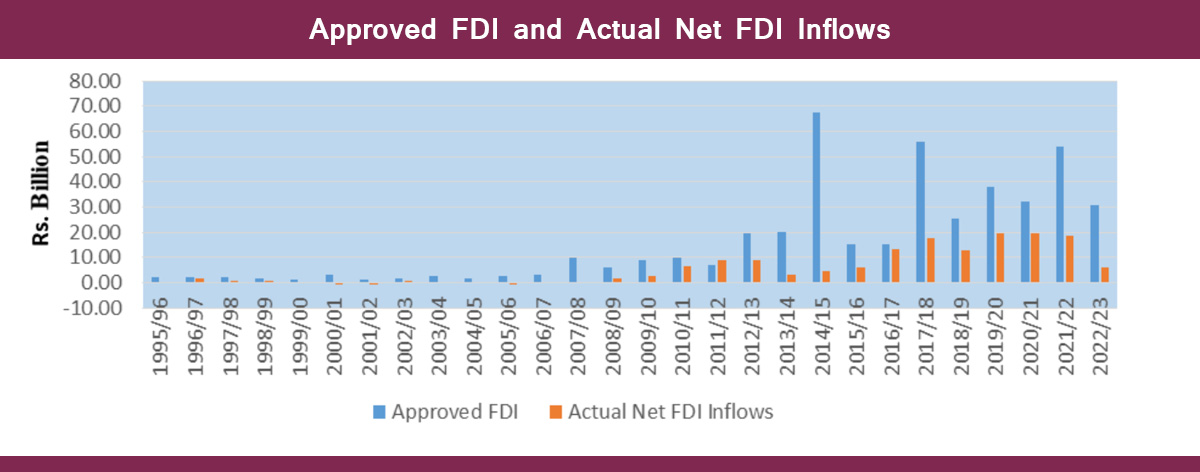

KATHMANDU: Nepal’s foreign direct investment (FDI) stock increased by 11.8% to reach Rs 295.5 billion by the end of the 2022/23 fiscal year, according to the Survey Report on Foreign Direct Investment in Nepal 2022/23 published by the Nepal Rastra Bank (NRB) on Friday.

The composition of FDI stock reveals that paid-up capital accounted for 52.8% of the total FDI stock. This indicates that foreign investors are increasingly committing long-term capital to Nepal’s economy. In contrast, reserves and loans contribute 33.7% and 13.5% to the FDI stock, respectively,

A sectoral analysis of the FDI stock reveals that the industrial sector remains the most attractive for foreign investors accounting for 59.7% of the total FDI stock. Within this sector, the electricity, gas, steam, and air conditioning industries hold the highest share at 30%, followed by the manufacturing sector at 29.4%. The service sector was next accounting for 40.2% of the total FDI stock. Among the service industries, financial and insurance services lead with 26% of the total indicating strong foreign interest in Nepal’s growing financial sector.

The information and communication sector and the accommodation and food services sector were next, with contributions of 6.7% and 6.3%, respectively, to the total FDI stock.

Nepal has attracted FDI from 58 countries as of mid-July 2023. India tops the list with Rs.103.5 billion in FDI stock, while China ranks second with Rs 35.5 billion, followed by Ireland (Rs.22.6 billion), Australia (Rs.19.1 billion) and Singapore (Rs.18.8 billion).

Additionally, foreign loans, excluding direct loans from foreign investors, amounted to Rs.60.3 billion as of mid-July 2023. The hydropower sector was the primary beneficiary of these loans, with outstanding loans in this sector standing at Rs 29.3 billion.

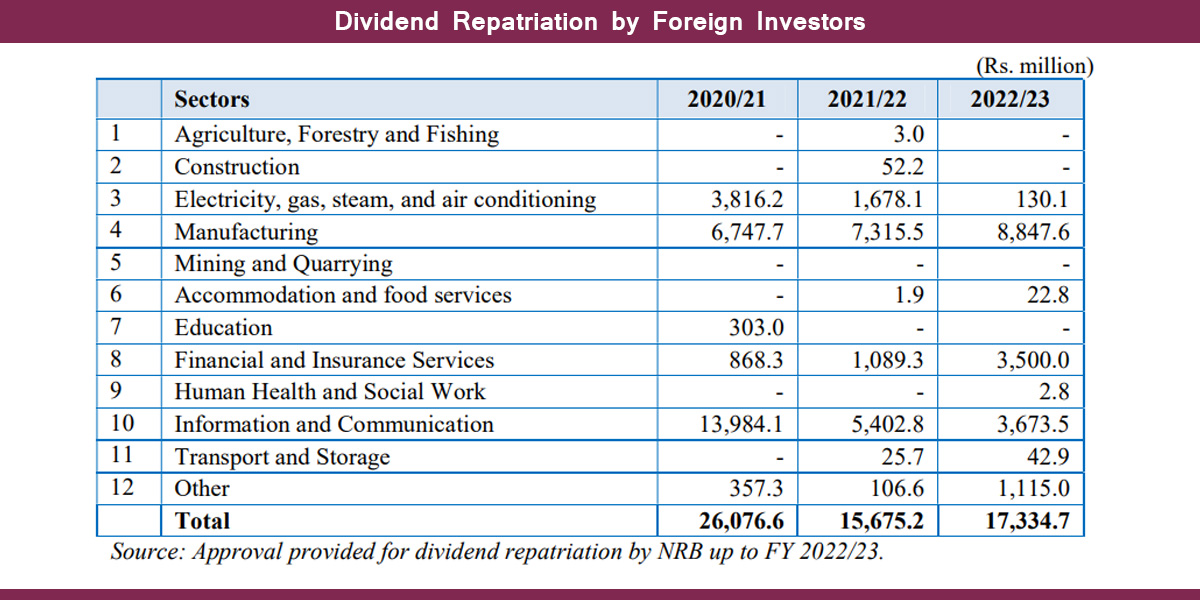

Foreign investors repatriated Rs.17.33 billion in dividends in 2022/23, according to the report. The highest dividend repatriation approval was for the manufacturing

sector followed by the information and communication sector.

Himal Press

Himal Press