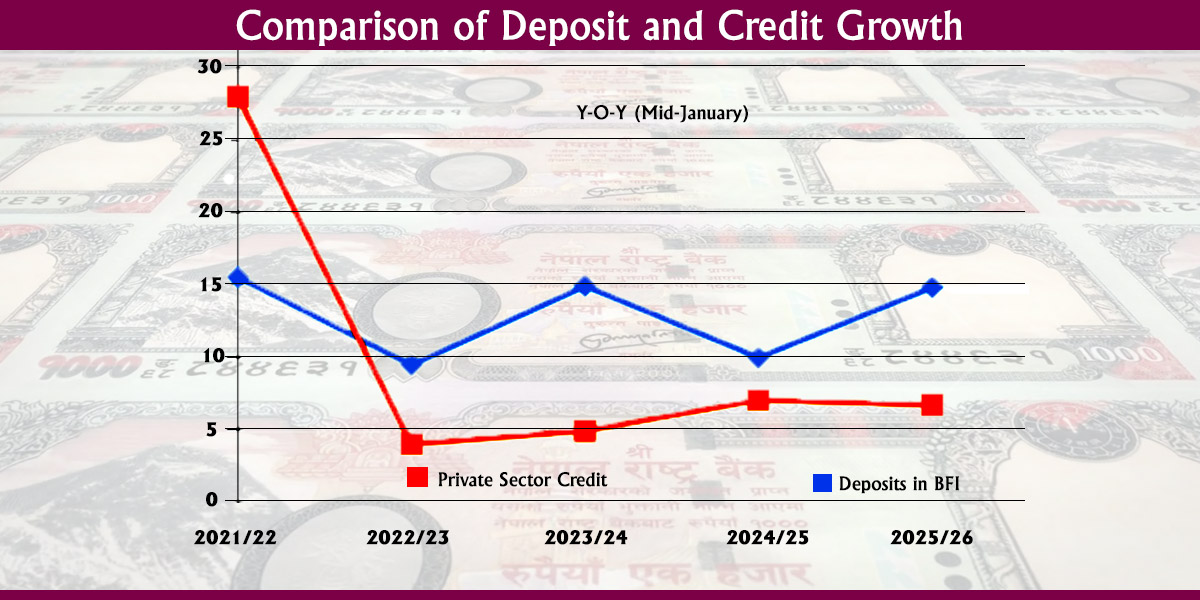

KATHMANDU: Credit growth in the banking system remained sluggish over the first half of the current fiscal year despite low interest rates, even as deposits continue to rise sharply, reflecting weak economic activity and cautious lending.

The recent Nepal Rastra Bank (NRB) data show that deposits at banks and financial institutions (BFIs) increased by 5.7%, or Rs 417.48 billion, over the first six months of the current fiscal year, reaching Rs 7,681.35 billion by mid-January 2026. This growth is significantly higher than the 3.7% increase recorded in the corresponding period of the previous fiscal year.

On a year-on-year basis, deposits expanded by a robust 14.8%.

Analysts say the surge in deposits, despite limited expansion in lending, indicates a lack of attractive investment opportunities and subdued economic activities in the country. They say businesses and households appear reluctant to borrow even though lending rates have eased, while savings continue to pile up in the banking system.

The composition of deposits has also changed over the year. As of mid-January 2026, fixed deposits accounted for 42.8% of total deposits, down sharply from 52.6% a year earlier. This is largely due to low deposit interest yields. In contrast, savings deposits rose to 41.3% from 34.1%, and demand deposits increased to 6.9% from 5.6%. This trend suggests depositors are increasingly preferring more liquid instruments amid economic uncertainty. The share of institutional deposits remained nearly unchanged at 35.1%.

On the lending side, private sector credit from BFIs grew by just 3.6%, or Rs 197.47 billion, during the review period, reaching Rs 5,695.17 billion. This is lower than the 5.2% growth recorded in the same period of the previous fiscal year. On a year-on-year basis, private sector credit expanded by only 6.7% by mid-January.

Data show credit growth remained uneven across institutions. Loans from commercial banks increased by 3.7%, while development banks and finance companies posted more modest growth of 2.9% and 1.2%, respectively.

In terms of borrowers, non-financial corporations accounted for 62.7% of private sector credit, while households absorbed 37.3%. Compared to a year ago, the share of household credit has risen slightly. This suggests relatively higher demand for personal and consumption-related loans than for corporate investment.

Sector-wise, outstanding loans to the consumable sector rose by 9.1%, followed by construction at 7.2%, and transportation, communication and the public sector at 6.2%. Industrial production saw a modest increase of 4.4%, while service industries recorded a minimal growth of 0.9%. Lending to the agriculture sector declined by 1.1%.

Collateral-backed loans accounted for 63.9% of total outstanding credit, while loans backed by current assets stood at 15%.

Himal Press

Himal Press