Representative Image

Representative Image

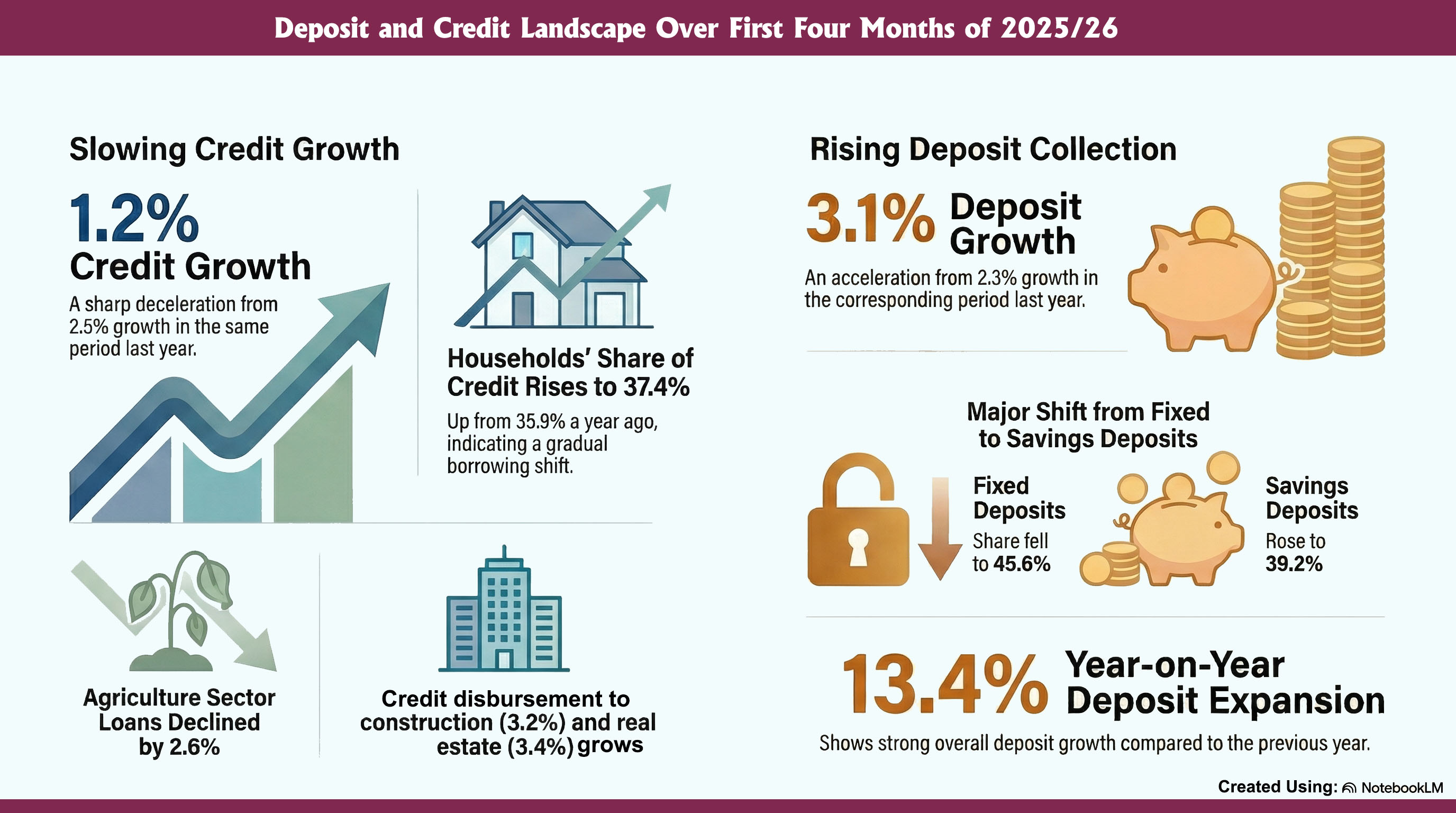

KATHMANDU: Credit disbursement to the private sector slowed in the first four months of the current fiscal year.

According to the Current Macroeconomic Situation Report for the first four months of 2025/26 released by Nepal Rastra Bank (NRB) on Monday, private sector credit from banks and financial institutions (BFIs) increased by 1.2%, or Rs 65.04 billion, to reach Rs 5,562.75 billion in mid-November. This marks a sharp deceleration compared to a 2.5% rise, or Rs 128.47 billion, in the first four months of the previous fiscal year.

On a year-on-year basis, private sector credit expanded by 6.9% as of mid-November 2025.

Credit distribution to non-financial corporations accounted for 62.6% of total private sector credit, while households received 37.4%. Such disbursements to non-financial corporations and households stood at 64.1% and 35.9%, respectively, in the same period of the previous fiscal year.

Private sector lending by commercial banks and finance companies each grew by 1.3% during the review period. In contrast, credit from development banks contracted marginally by 0.1%.

As of mid-November 2025, 64.4% of total outstanding credit was backed by land and buildings, down from 66% a year ago, while loans secured by current assets such as agricultural and non-agricultural products rose to 15% from 13.5%.

Sector-wise, lending to the construction sector recorded the highest growth of 3.2%, followed by transportation, communication and public sector (2.9%), and industrial production (1.9%). Credit to the consumable sector rose by 1.7%, wholesale and retail by 0.4%, and service industries by a marginal 0.1%. However, loans to the agriculture sector declined by 2.6%, while credit to finance, insurance and fixed assets fell by 2.5%.

In terms of loan categories, margin loans expanded by 3.9% and real estate loans, including residential personal home loans, by 3.4%. Cash credit loans rose by 1.8%, hire purchase loans by 1.3%, demand and other working capital loans by 1.1%, and term loans by 0.9%. Overdraft loans and trust receipt (import) loans, however, declined by 4.9% and 2.1%, respectively.

Deposit collection, on the other hand, showed a modest improvement over the first four months of the current fiscal year.

Deposits at BFIs increased by 3.1%, or Rs 222.38 billion, reaching Rs 7,486.25 billion during the review period. This compares with a 2.3%, amounting to Rs 149.84 billion, in the corresponding period of the previous fiscal year. On a year-on-year basis, total deposits expanded by 13.4% as of mid-November 2025.

As of mid-November 2025, fixed deposits accounted for 45.6% of total deposits, down sharply from 54.5 percent a year earlier. Savings deposits rose to 39.2% from 32.8%, while demand deposits increased to 6.0% from 5.3%. Institutional deposits constituted 35.5% of total deposits, marginally lower than 35.8% recorded a year ago.

Himal Press

Himal Press