KATHMANDU: Remittances inflow jumped 29.9% over the first month of the current fiscal year 2025/26.

According to the Current Macroeconomic Situation Report published by the Nepal Rastra Bank (NRB) on Monday, Nepal received Rs 177.41 billion in remittances between mid-July and mid-August, up from Rs 136.60 billion in the same period of 2024/25.

In US dollar terms, remittance inflows went up by 25% to $1.27 billion.

The rise in remittances coincided with an increase in labor migration. A total of 44,466 Nepali workers received first-time approvals for foreign employment in the review period up from 36,928 in the same period of 2024/25. Likewise, 23,644 received re-entry approvals between mid-July and mid-August, up from 22,647 in the same month last year.

Net secondary income (net transfers) also climbed to Rs 193.85 billion, up from Rs 148.08 billion a year earlier.

Current account, BoP in surplus

The current account surplus widened to Rs 78.14 billion ($561 million) in the first month of 2025/26. According to the report, the surplus is more than double last year’s surplus of Rs 33.08 billion ($246.8 million).

Similarly, the Balance of Payments (BoP) surplus more than doubled, reaching Rs 89.30 billion ($641.2 million) against Rs 40.90 billion ($305.1 million) in the corresponding period of the previous fiscal year.

Net capital transfer surged to Rs 1.04 billion, up from Rs 223.2 million in the first month of the previous fiscal year.

However, foreign direct investment (FDI) equity inflows dipped to Rs 691.5 million in the review month, down from Rs 799.8 million in the same month of the previous fiscal year.

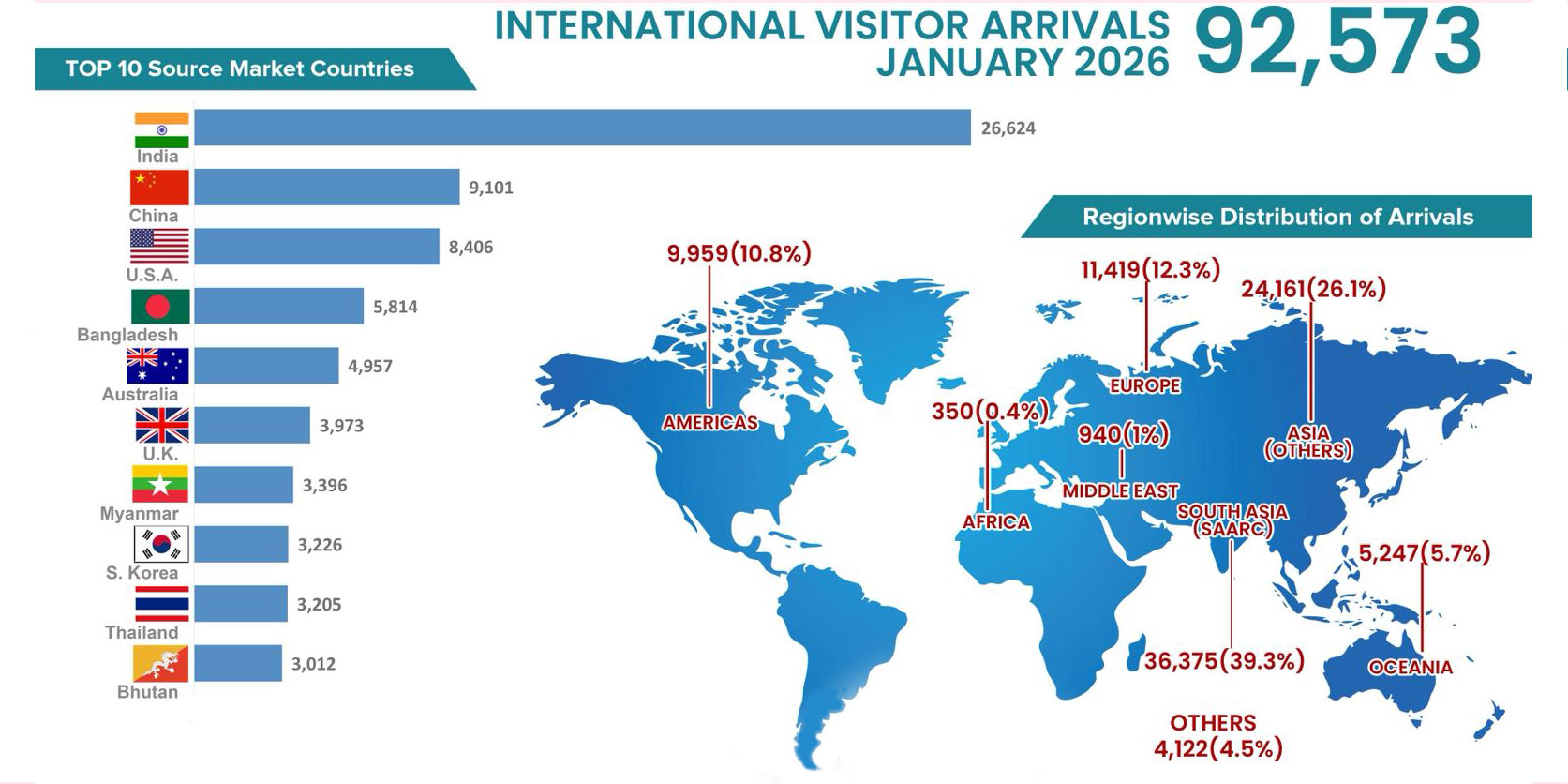

Likewise, travel income rose 12.7% percent to Rs 5.38 billion in the review month. Although travel payments declined by 2.8% to Rs 21.70 billion, it is four times higher than the travel income received during the month.

Foreign exchange reserves at record high

Gross foreign exchange reserves increased 4.8% percent to Rs 2,806.04 billion in mid-August 2025 from Rs 2,677.68 billion a month earlier.

In US dollar terms, reserves expanded by 2.7% to $20.03 billion.

Of the total, reserves held by the central bank grew to Rs 2,511.45 billion, while those held by banks and financial institutions jumped 12% to Rs 294.58 billion. The share of Indian currency in total reserves stood at 23.4%.

Based on the latest trade data, the reserves are sufficient to cover 20.4 months of prospective merchandise imports and 16.6 months of goods and services imports.

Himal Press

Himal Press