KATHMANDU: Banks are seeing investable funds pile up as demand for credit slows in the market.

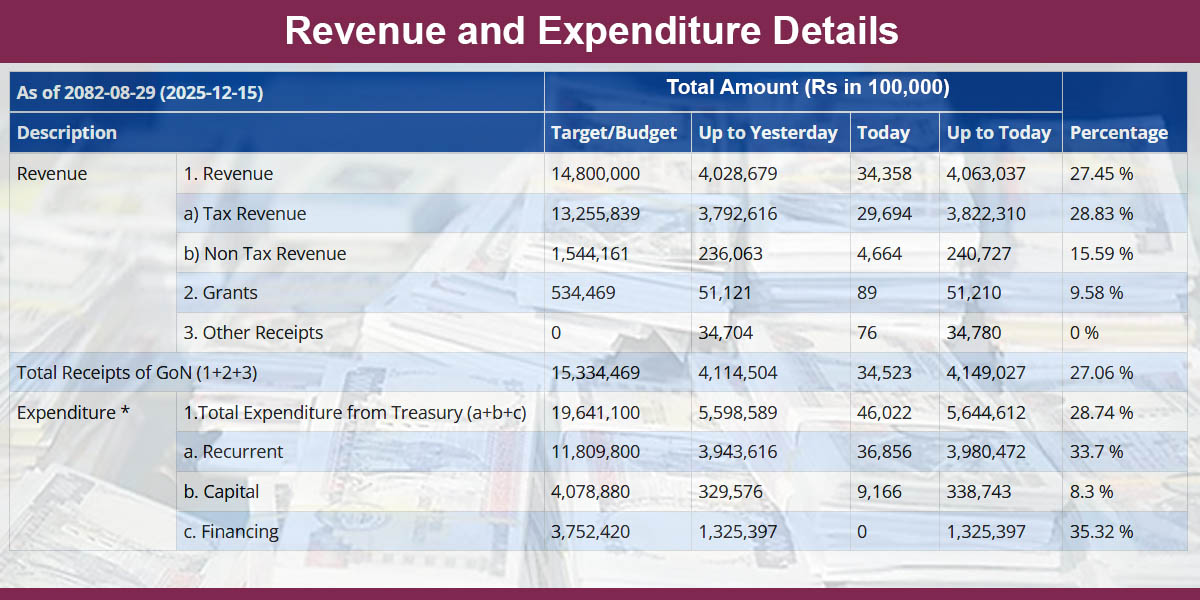

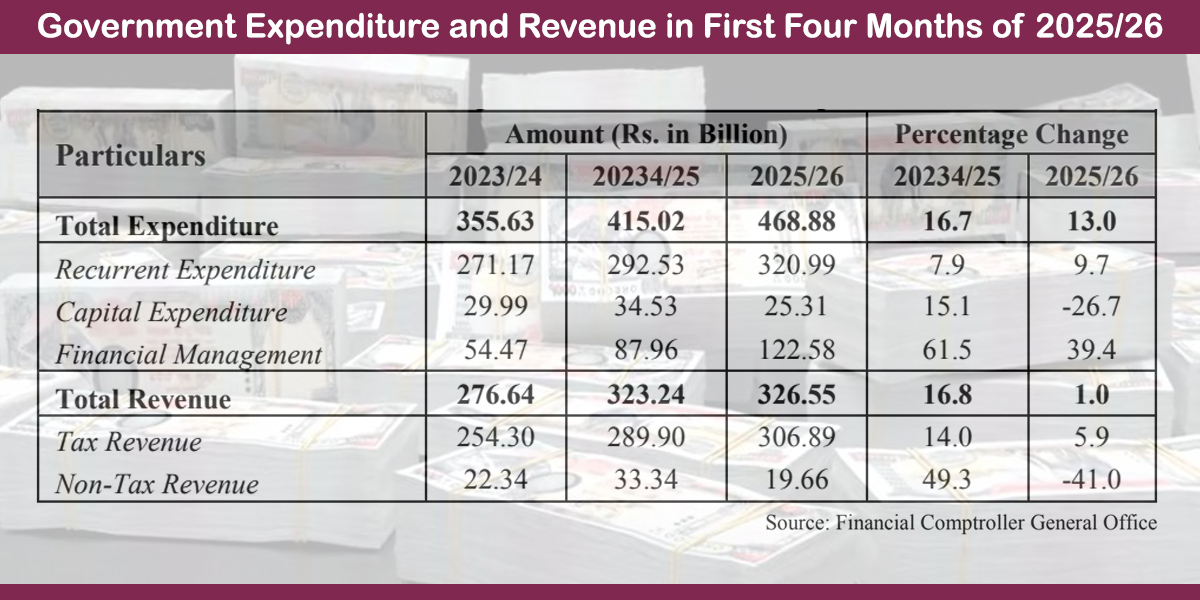

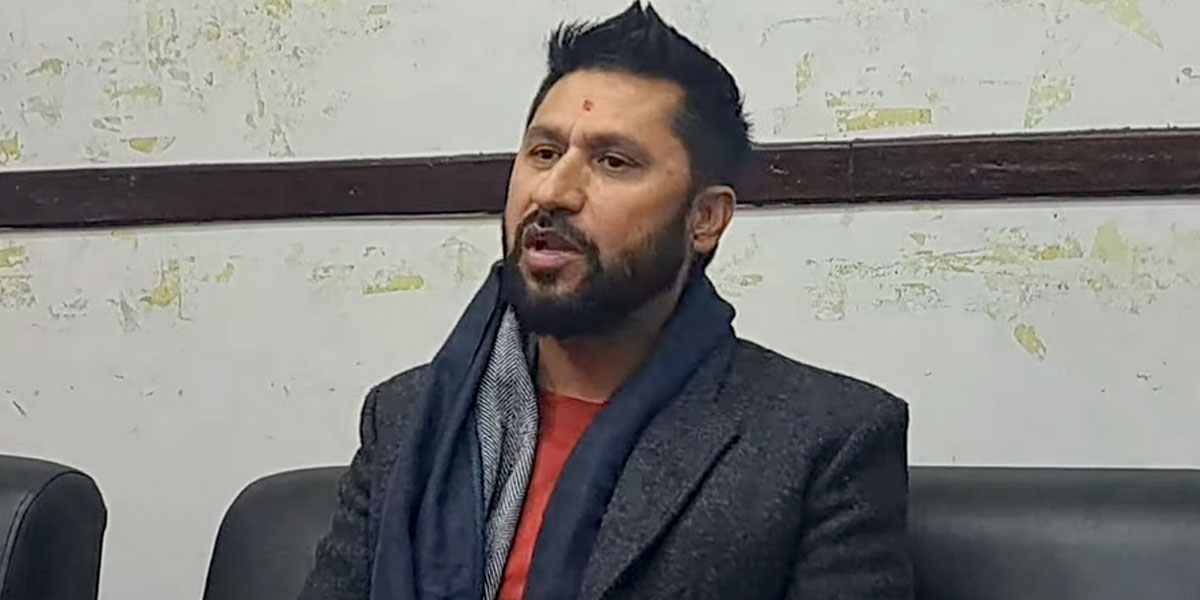

According to the Nepal Bankers’ Association (NBA), total deposits in commercial banks reached Rs 5,903.57 billion in mid-November. Banks have total investable funds of as high as Rs 711.38 billion, says NBA President Sunil KC.

“Policies taken to create demand for credit have become ineffective,” KC told Himal Press.

According to the Nepal Rastra Bank (NRB), loan disbursement till mid-November stands at Rs 4,679.91 billion.

The credit-to-deposit (CD) ratio reached 63% in mid-November. Banks are allowed to maintain a maximum CD ratio of 90%. However, the CD ratio of commercial banks is gradually decreasing. This shows banks have huge investable funds.

KC, however, added that credit disbursement has shown signs of improvement in the eighth month (mid-November to mid-December) of the fiscal year 2024/25. “Banks are awash with cash as credit demand is not coming from industrial and real estate sectors. As a result, interest rates on loans from most banks have fallen to single digits,” KC said. “A lack of demand for credit from key sectors like hotels, tourism, agriculture, small and large industries, and construction has caused investable funds to pile up.”

Nepal Rastra Bank’s data show that industries, construction, and wholesale and retail businesses have been in negative growth for the past three years. According to the central bank, investable funds in banks are expanding due to low credit demand from these sectors.

NRB Spokesperson Ramu Paudel said the current fiscal year is seeing patterns similar to previous years in terms of investable funds accumulation. “Discussions are ongoing with stakeholders to address and utilize these idle funds,” he added.

On Sunday, the Nepal Rastra Bank (NRB) absorbed Rs 50 billion of excess liquidity from the banking system through a deposit collection auction. “We have already mopped up liquidity three times this month (mid-November to mid-December),” he added.

Banks have been progressively reducing interest rates as investable funds continue to accumulate.

Himal Press

Himal Press