KATHMANDU: Nepal Rastra Bank (NRB) has kept key policy rates unchanged in its first-quarter review of the Monetary Policy for the Fiscal Year 2024/25.

The central bank has stated that it is continuing a cautious and flexible policy approach. It said that its policy direction is based on an analysis of the current economic landscape, foreign exchange reserves, and inflation trends.

The monetary policy review has maintained the policy rate at 5%. The deposit collection rate under the interest rate corridor’s lower limit remains at 3%, while the bank rate at the upper limit of the interest rate corridor has been kept unchanged at 6.5%. The mandatory cash reserve ratio and statutory liquidity ratio have been maintained at their current levels.

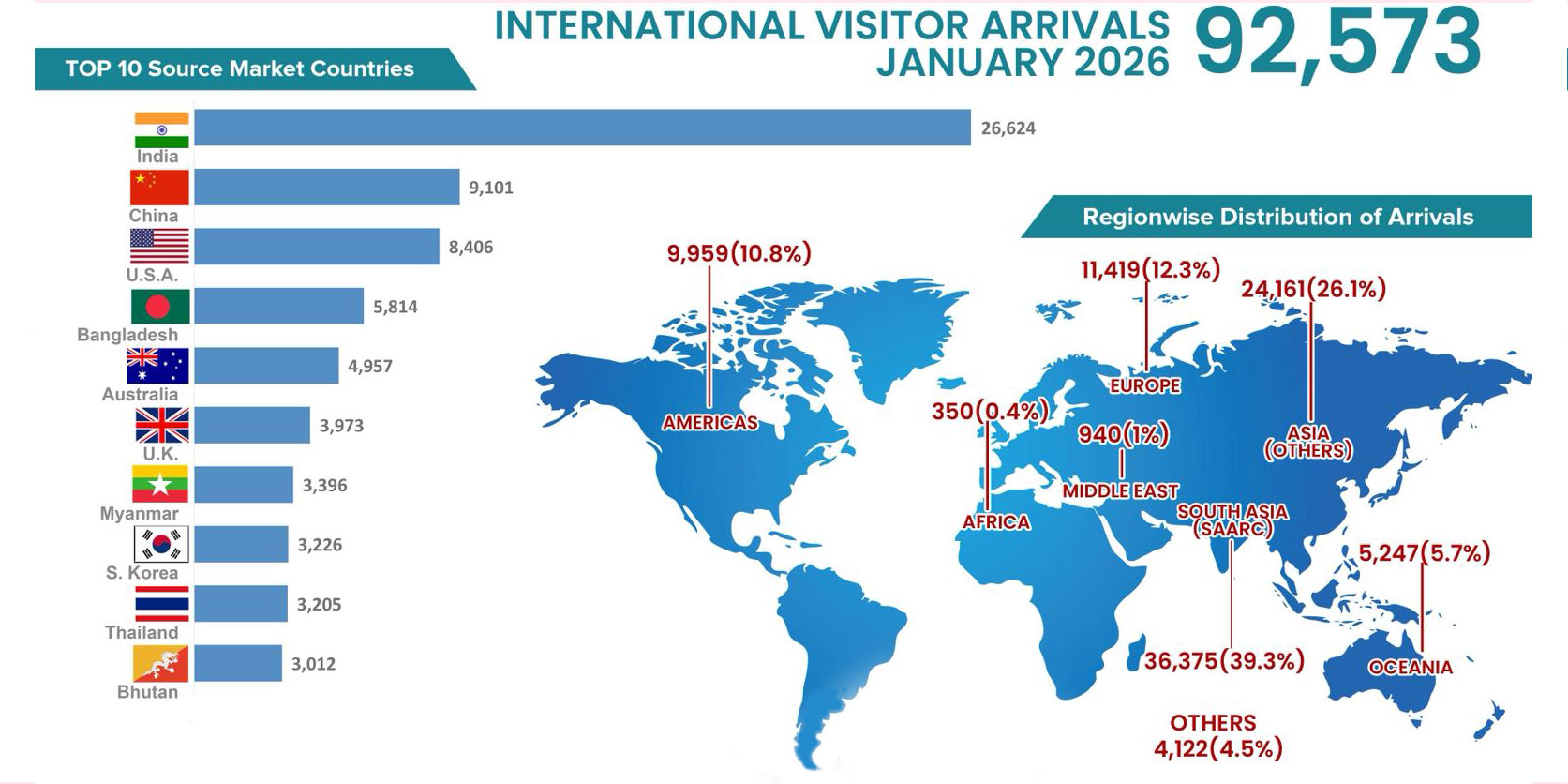

According to the review, the central bank anticipates an expansion of overall demand due to several factors, including increased tourist arrivals, growing utilization of tourism infrastructure, expansion of the information technology sector, progress in hydroelectric project construction, and reconstruction of damaged projects. These factors are expected to help achieve the targeted economic growth for the current fiscal year, the NRB said in its review.

The central bank has estimated the economic damages caused by September end’s rainfall and floods at approximately Rs 46 billion. The government will need to make significant expenditures on infrastructure repair and post-disaster reconstruction, which will create some pressure on public financial management, it said in the review.

The NRB, however, added that it expects the infrastructure spending to help stimulate other economic sectors and potentially increase bank loan demand for investments.

Key observations from the review include that inflation has remained within the targeted range during the first quarter of the current fiscal year. It, however, highlighted potential risks such as high food inflation in India, ongoing geopolitical tensions in the Middle East, and continued complications from the Russia-Ukraine conflict, which could disrupt supply chains and potentially impact consumer prices.

Regarding foreign exchange reserves, the central bank said that the reserves as of mid-October could cover 14.6 months of goods and services imports. The bank anticipates continued favorable foreign exchange reserves due to the increasing number of Nepalese workers going abroad and growth in remittance inflows.

Himal Press

Himal Press