KATHMANDU: Nepal Rastra Bank (NRB) released the Monetary Policy for the fiscal year 2023/24 on Sunday, introducing several key measures to stimulate economic growth and address changing financial dynamics in the country.

Here are the highlights of the monetary policy:

- Policy Rate Cut: In response to the current internal and external economic conditions, the NRB has reduced the policy rate by 50 basis points to 6.5 percent. This move aims to promote borrowing and boost economic activities in the market. The bank rates will remain unchanged at 7.4%, while the deposit collection rate (auction) has been lowered to 4.5% from 5%.

- Interest Rate Corridor: To enhance the effectiveness of the interest rate corridor, the NRB has announced that permanent deposit collection facilities will be made available at the lower limit of the interest rate corridor. This measure is expected to provide more stability and predictability in interest rates.

- Residential House Loan Limit: The NRB has decided to increase the limit for first residential house loans from Rs. 15 million to Rs. 20 million, making it easier for individuals to access housing finance. This move is expected to give a boost to the real estate sector, which has been suffering due to tightened housing loans.

- Working Capital Loans: The NRB has said it would make a necessary review of the guidelines related to working capital loans. The central bank had previously tightened working capital loans stating that borrowers were using the credit to invest in real estate and the stock market. Additionally, the NRB has said that will review the provision that requires borrowers using loans exceeding a certain limit from banks and financial institutions to obtain a permanent account number.

- Review of CAR: The central bank plans to review the existing provisions for the capital adequacy ratio for margin lending, real estate loans, and hire purchase loans.

- Microfinance Mergers: The NRB aims to encourage mergers and acquisitions among microfinance financial institutions by extending the timeframe for enjoying existing facilities until the end of the current fiscal year.

- Foreign Exchange Limit: Nepalese citizens traveling to countries other than India will now be provided exchange facilities for up to $2,500 twice a year. The central bank had earlier capped the limit at $1,500 to check the depletion of foreign currency reserves.

- Facility for Foreign Currency Loans Withdrawn: With the impact of COVID-19 diminishing, the existing facility of allowing borrowers to repay their foreign currency loans in Nepali currency has been discontinued.

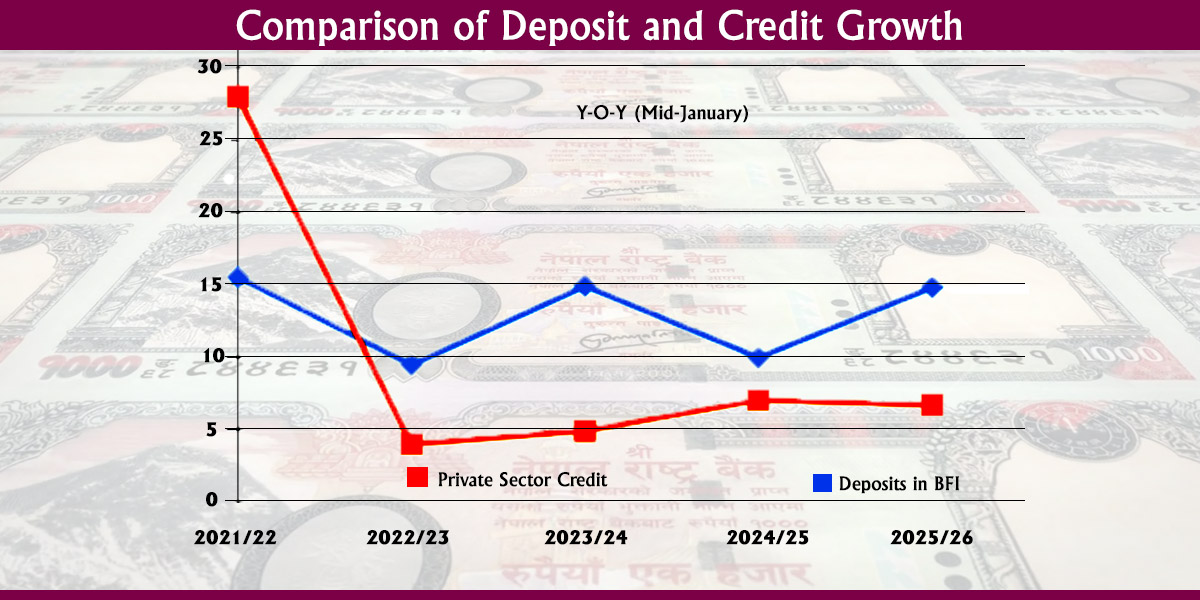

- Monetary Projections: The central bank has forecast M2 and loans from banks and financial institutions to the private sector to increase by 12.5% and 11.5%, respectively. M2 measures the nation’s overall stash of cash, coins, bills, bank deposits, and money market funds and is considered the broadest measure of cash and cash-like liquid assets, according to Reuters.

Published On: 23 Jul 2023

Comments

Himal Press

Himal Press