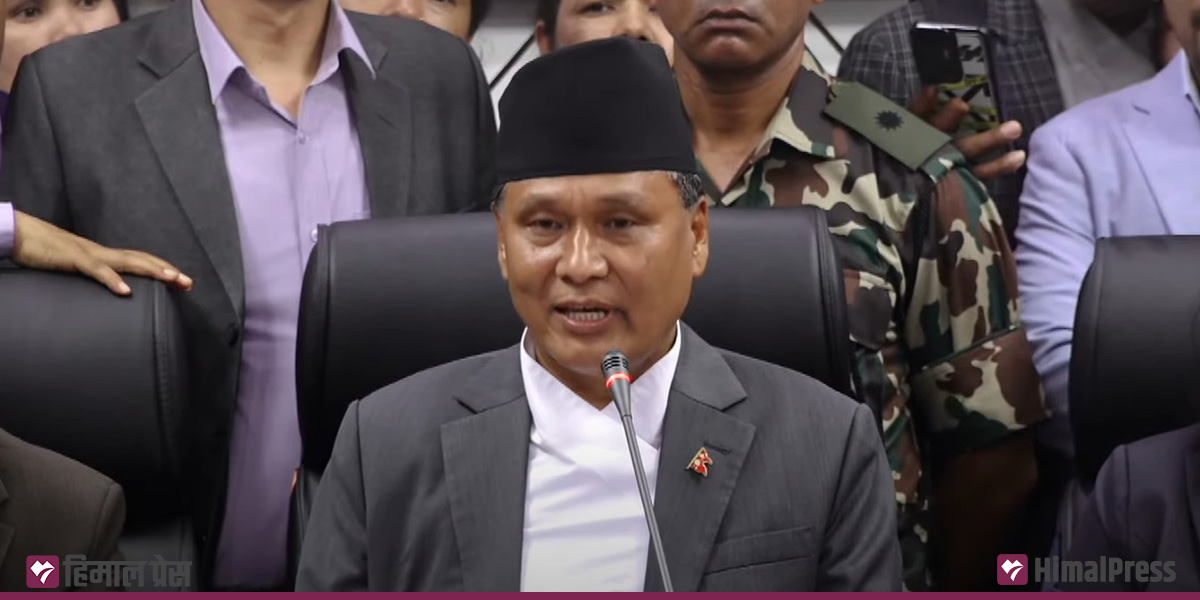

KATHMANDU: The newly appointed Executive Director of the Nepal Electricity Authority (NEA), Hitendra Dev Shakya, has said that a due diligence audit (DDA) of the utility will be conducted to determine the NEA’s actual financial position, verify the reliability of reported data, and assess financial, technical, and managerial aspects, including the status of assets and liabilities.

Issuing a white paper on Friday, Shakya said the Office of the Auditor General (OAG) has pointed out several discrepancies within the organization, including Rs 7.19 billion in unrecorded expenses, Rs 4.72 billion in overstated income and Rs 29.91 billion in unaccounted revenue.

Shakya added that the profit and loss statement of the NEA for 2023/24 requires further adjustments, and the reported loss may not reflect potential liabilities. He also said that the NEA is currently facing a net loss of Rs 5.26 billion.

“We have issued this document to help formulate the authority’s strategic direction and assess progress made during his tenure. It was also necessary to evaluate the organisation’s performance since I assumed office,” he added.

Shakya explained that the white paper aims to provide transparency and establish a data-backed foundation for future planning.

He added that NEA’s cumulative profit up to the fiscal year 2023/24 stood at approximately Rs 46.47 billion. “By mid-March 2025, the NEA had recorded a profit of Rs 9.48 billion. However, after factoring in additional depreciation claims under the Income Tax Act, the authority ended up with a net loss of Rs 5.26 billion,” Shakya added.

Shakya also said that NEA was preparing to borrow Rs 10 billion to manage its cash flow program. “Since we don’t have a cash balance, we have already sent a letter to the government seeking approval for a loan of Rs 10 billion,” Shaky added. He added that the outstanding bills of contracts amounting to Rs 11.61 billion have still to be paid.

Of the approximately Rs 10.10 billion currently available in the NEA’s fund, Rs 3.68 billion is held in a fixed deposit account, Rs 3.95 billion is in a deposit account and Rs 2.47 billion is in a call/current account.

Himal Press

Himal Press