KATHMANDU: The government’s effort to increase savings by establishing multiple funds without clearly defining their scope has not achieved its intended purpose. Non-banking institutions of the government such as the Employees Provident Fund (EPF), Citizen Investment Trust (CIT), and Social Security Fund (SSF) are operating similar gratuity and pension schemes.

In December 2018, the government established the SSF with the objective of covering workers in the informal sectors. However, this initiative has not been successful. The government had announced that it would contribute the employer’s share for informal sector workers if they contributed 11% of their earnings. For workers in the formal sector, employees contribute 11% while companies add 20% to the SSF.

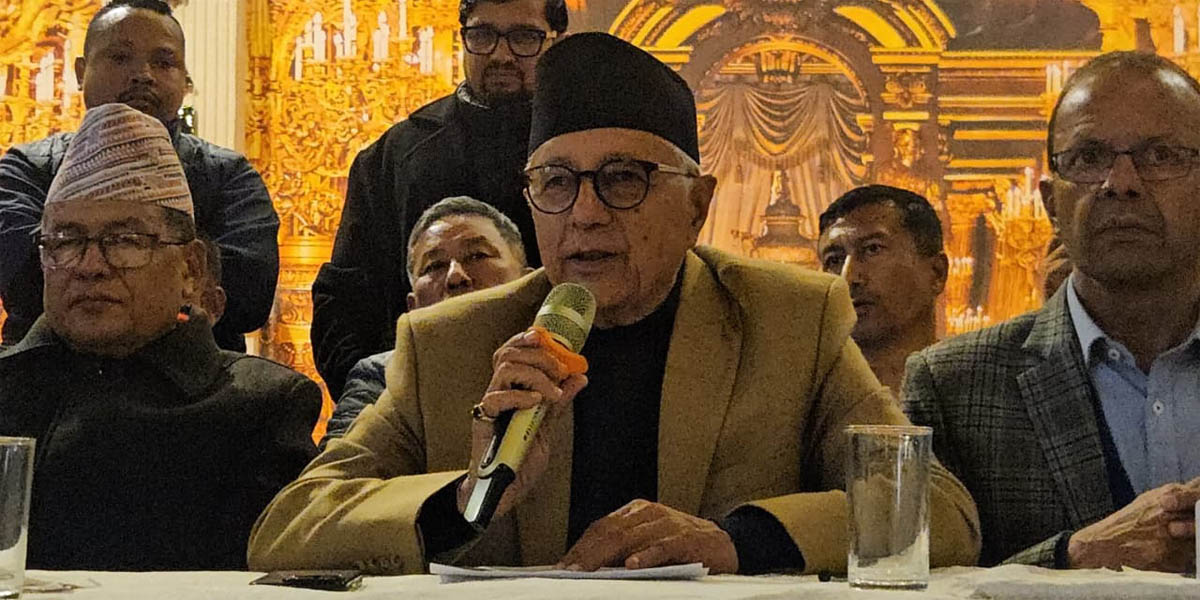

Economist Dr Dilli Raj Khanal says that the government itself has been the biggest obstacle in advancing this fund according to its objectives.

The government’s announcement to include people in contribution-based social security has not been implemented as planned. Instead, the government has pressured the formal sector to join the SSF, while many industrial establishments have shown reluctance to participate. Participation in the SSF should be voluntary rather than mandatory, according to Dr Khanal.

As the SSF began offering services similar to existing funds and increased pressure for mandatory participation, the CIT launched its own competing scheme called the Citizen Pension Plan. In late 2020, the CIT initiated a pension scheme allowing informal sector workers to participate by saving as little as Rs 500 per month, with flexible provisions.

The CIT has mobilized Rs 210 billion in savings.

During this period, the SSF has registered 19,574 employers and 1,617,720 employees, while mobilizing Rs 64.41 billion in savings. Despite the government’s attempt to attract participation by setting a comparatively high contribution rate for employers, many have shown reluctance to register with the SSF. By establishing funds that perform similar functions, it appears the government is targeting mandatory savings (forced saving) rather than providing convenience to savers.

The EPF has mobilized Rs 518.47 billion in savings over its 63-year service period. It has 33,600 affiliated institutions and 575,000 contributors. The EPF’s pension fund has accumulated Rs 11.21 billion. Contributors to the EPF must deposit 10% of their salary, with employers matching this amount.

EPF has been listing private sector institutions on a voluntary basis. Stating that some private contributors or employers prefer to remain with the EPF, a former administrator of the EPF said issues have arise due to mandatory participation in the SSF and voluntary participation in the EPF.

The court, however, has ruled that participation in the SSF cannot be made mandatory.

“There is no need for multiple institutions doing the same kind of work. There should be just one institution for cost-effective management,” the former administrator said. “If a single institution can manage funds covering millions of people in a large country like India, there is no need for multiple institutions to manage just a few hundred thousand contributors.”

Based on six decades of experience, the EPF is capable of properly managing all these funds, the former administrator said. “All these funds could be merged and operated under the leadership of the EPF. Since other funds have adopted a strategy of earning interest by keeping a large portion of savings in banks and financial institutions, this approach has not provided the expected benefits to the economy,” he added.

Deependra Bahadur Kshetri, former Vice-Chairman of the National Planning Commission and former Governor of Nepal Rastra Bank, says the real sector of the economy cannot develop until investment areas are identified and investments are made with calculated risks. “Without real sector development, there will be no increase in production and employment. Consequently, such an economy cannot achieve stability,” he added.

The EPF has invested 97-98% of its mobilized savings, with about 60% flowing back to contributors through various schemes. It provides loans to its contributors for land purchase, house purchase or construction, home repairs, education and special loans. As at 2023/24 end, 53,865 contributors have taken various types of loans from the EPF.

Jitendra Dhital, the chief administrator, of the EPF said they have made significant investments in hydropower and infrastructure projects, including over Rs 70 billion in the hydropower sector alone. The EPF has invested in 10 projects with a total capacity of 1,172 megawatts and has also provided substantial loans to Nepal Airlines Corporation to purchase aircraft.

The EPF has also made notable investments in promoter shares of 11 banks and financial institutions. It owns a 12.62% stake in Himalayan Bank and 15% in Nepal SBI Bank. Additionally, it has kept about 30% of its total resources as deposits in banks.

This makes the EPF the largest depositor in the country. According to the Nepal Rastra Bank, by the end of June, the fund had parked Rs 187.41 billion rupees in different banks.

The EPF has been prioritizing portfolio diversification and identifying new investment areas, Dhital added.

Himal Press

Himal Press