Representative Image

Representative Image

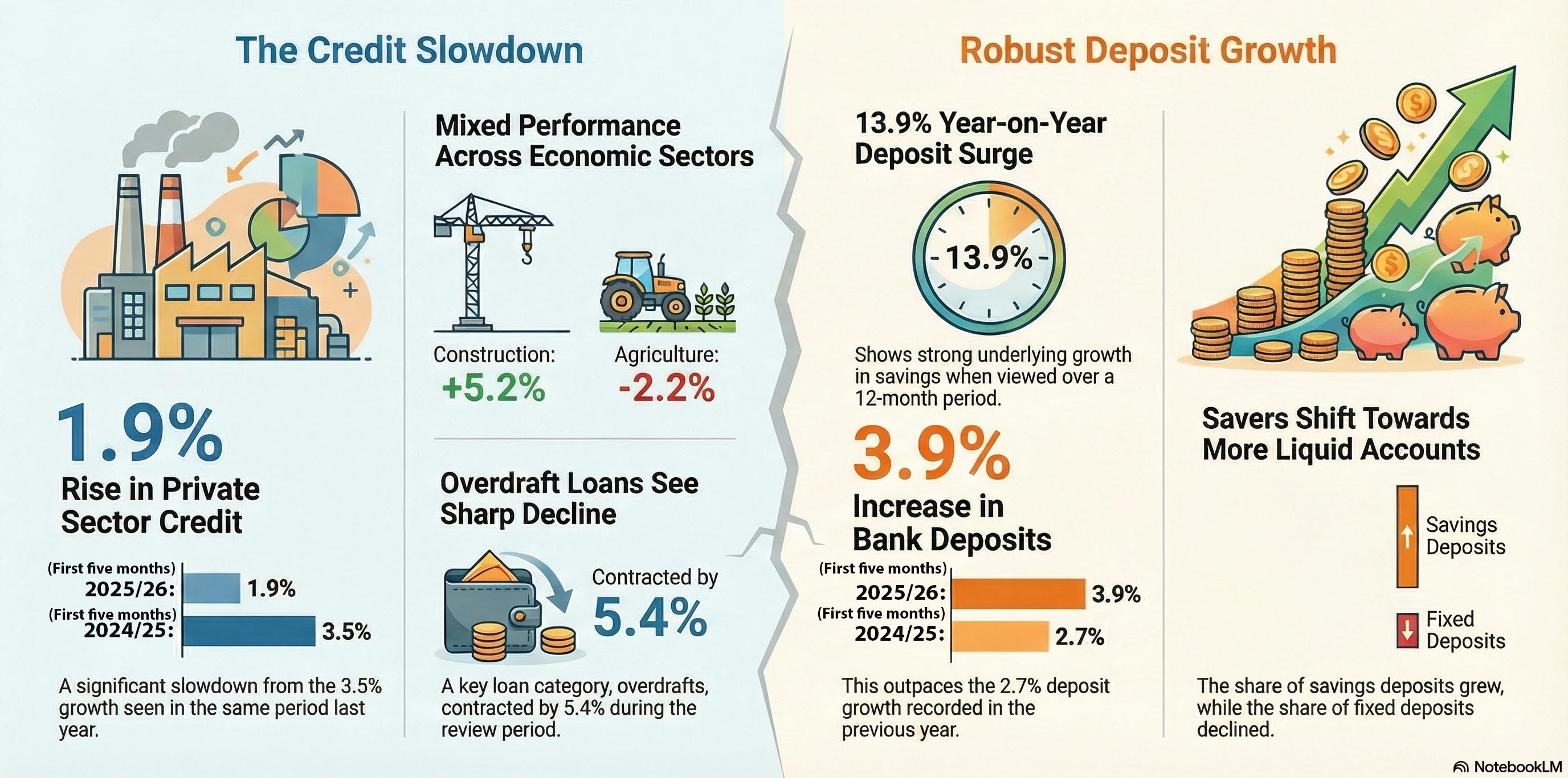

KATHMANDU: Credit disbursement by banks and financial institutions (BFIs) slowed in the first five months of the current fiscal year 2025/26.

According to the Current Macroeconomic and Financial Situation Report for the first five months of 2025/26 released by the Nepal Rastra Bank (NRB) on Friday, private sector credit from BFIs increased by 1.9%, or Rs 102.24 billion, to Rs 5,599.95 billion in mid-December. In the same period of the previous fiscal year, credit to the private sector had increased by 3.5%, or Rs 178.29 billion.

Credit from commercial banks rose by 2%, followed by finance companies at 1.2% and development banks at 0.8%.

On a year-on-year basis, however, credit to the private sector increased by 6.6% in mid-December.

Of the total outstanding private sector credit, 62.7% was extended to non-financial corporations and 37.3% to households, a slight shift toward household lending compared to a year earlier.

Sector-wise, lending increased to construction (5.2%), consumable goods (5.1%), transportation, communication, and public sector (3.5%), industrial production (2.5%), and services (0.4%). In contrast, credit to agriculture declined by 2.2%, while lending to finance, insurance, and fixed assets also fell by 2.2%.

In terms of loan types, hire-purchase loans grew by 6.1%, margin loans by 5.7%, and real estate loans, including residential home loans, by 3.7%. Similarly, cash credit and term loans posted modest growth, while overdraft loans declined by 5.4%.

Despite slower credit expansion, deposit mobilization remained robust. Deposits at BFIs increased by 3.9%, or Rs 281.89 billion, during the review period to reach Rs 7,545.77 billion, compared to a 2.7% rise a year earlier. On a year-on-year basis, deposits surged by 13.9%.

According to the report, savings deposits rose to 39.9% of total deposits in mid-December, while the share of fixed deposits declined to 44.6%.

Himal Press

Himal Press