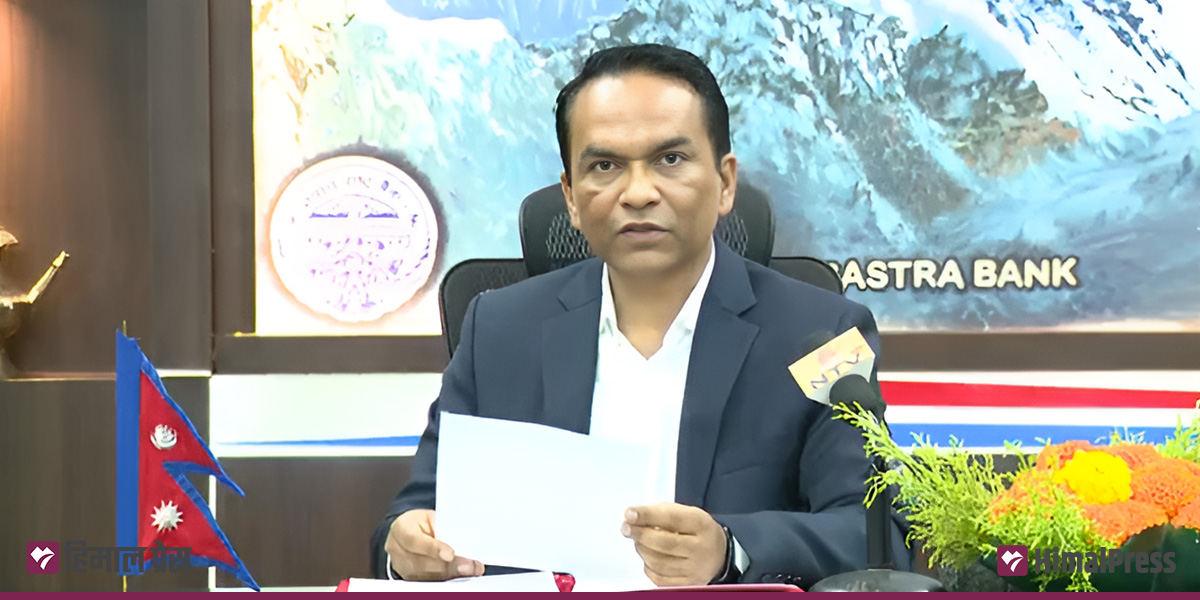

KATHMANDU: Nepal Rastra Bank (NRB) has announced a reduction of one percentage point in the interbank rate.

In the third quarterly review of the Monetary Policy for Fiscal Year 2022/23, the central bank has lowered the interbank rate to 7.5% from 8.5%. However, the policy rate remains unchanged at 7%. Additionally, the other rates within the interest corridor will also remain unchanged.

Since the central bank has decided to provide daily liquidity facilities to banks at the policy rate of 7%, down from the previous 8.5%, the interbank rate will decrease by 1.5 percentage points.

“The adjustment in the monetary policy has been cautiously made to provide flexibility, supporting domestic economic activities, and ensuring macroeconomic stability, considering the current situation and potential scenarios related to inflation and foreign exchange reserves,” states the monetary policy review.

The central bank has decided to extend the facility to calculate the loan-deposit ratio for bonds issued by banks and financial institutions as a valid source (deposit) until the first half of the fiscal year 2023/24. Likewise, it has decided to provide loan restructuring facilities for borrowers of sectors that have posted negative growth in the past two quarters based on the data of the National Statistics Office. This facility, however, is subject to the availability of funds.

NRB has said it will take needful decisions to allow microfinance institutions to restructure and reschedule the loans by assessing the needs and justification of the borrowers by mid-June.

Likewise, the central bank has said that needful arrangements will be made to allow banks and financial institutions to restructure/reschedule short-term and working capital loans of up to Rs 50 million by mid-June of the current fiscal year, for sectors like hotels and restaurants, animal husbandry and construction, among other sectors, after analyzing the cash flow situation of the borrowers.

Similarly, the NRB has said it will take needful decisions to allow microfinance institutions to restructure and reschedule the loans by assessing the needs and justification of the borrowers by mid-June.

Himal Press

Himal Press