KATHMANDU: Nepal’s legal and institutional reforms under fiscal federalism and public financial management at the provincial and local levels have continued albeit at a but at a moderate pace.

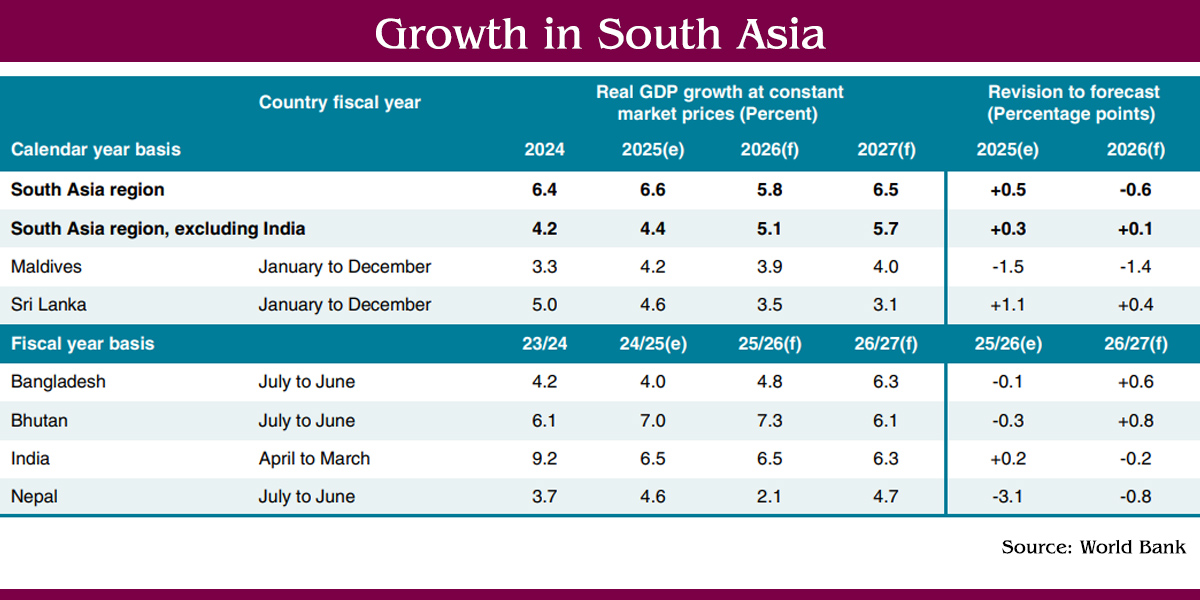

The Nepal Fiscal Federalism Update 2024, published by the World Bank Group on Monday, states a reduction of available financial resources in fiscal year 2023/24 for provincial and local governments, mainly due to a decrease in federal revenue, led to the first fiscal deficit at the subnational level since the outset of fiscal federalism in 2017.

According to Chief Secretary Dr Baikuntha Aryal, the update provides a comprehensive review of the progress of fiscal federalism in Nepal. “The recommendations are well aligned with our national-level vision on smoothing the fiscal transfers to help subnational governments carry out their responsibilities effectively,” he said. “The report also informs and supports our ongoing efforts to clarify responsibilities among the three tiers of government and advance fiscal federalism.”

The latest update explores in-depth the key pillars of fiscal federalism in Nepal: Revenue Assignment and Administration; Expenditure Assignment and Administration; Inter-Governmental Fiscal Transfers; Borrowing and Capital Finance; and Fiscal Revenue from Natural Resources.

It recommends specific measures to upgrade the Inter-Governmental Fiscal Transfer system and establish a consolidated public financial management performance database that includes data from the subnational levels to enhance evidence-based decision making and transparency.

“The report highlights the need to upgrade institutional arrangements for the Intergovernmental Fiscal Transfers system to make the transfers more needs-based and timely, and to increase the fiscal autonomy of provincial and local governments, in order to improve fiscal federalism outcomes,” Balananda Paudel, chairperson of the National Natural Resources and Fiscal Commission, said.

Among others, the report recommends strengthening provincial and local-level institutional arrangements for fiscal federalism and public financial management operations, including actions to improve budget credibility to improve delivery of services by subnational governments.

Commenting on the report, Faris Hadad-Zervos, the World Bank Country Director for Maldives, Nepal and Sri Lanka, said fiscal federalism is a foundation for sustained service delivery by provincial and local governments which need adequate financial resources and the ability to make spending decisions at the subnational level in the spirit of federalism and the constitution.

Himal Press

Himal Press