KATHMANDU: The government missed its revenue targets in the first half of the fiscal year 2022/23.

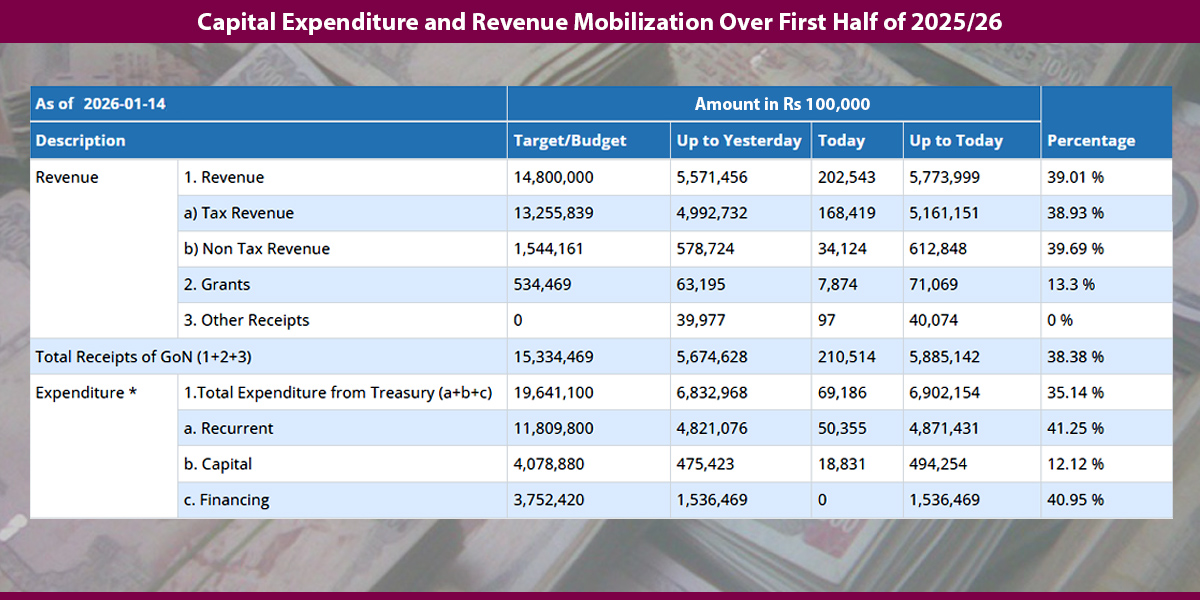

According to the Ministry of Finance, the country mobilized Rs 490.4 billion in revenue against the target of raising Rs 651.61 billion by the sixth month of the current fiscal year i.e. mid-January. This is 75.2% of the target set for the period.

Data released by the finance ministry shows customs revenue suffered the most. This can be attributed to the restriction on the import of selected goods as part of the government’s efforts to reduce strain on foreign exchange reserves.

Customs offices mobilized only 53% of the targeted Rs 161.82 billion from the customs revenue. Only Rs 85.78 billion was mobilized as customs revenue during the period.

Similarly, the government also missed the target on the collection of VAT and excise duty. Data shows the government could mobilize only 72% of the targeted Rs 180.24 billion from VAT in the review period. Likewise, customs offices could collect only Rs 70.51 billion as excise duty, lower than the targeted Rs 97.51 billion.

According to the ministry, Rs 116.79 billion has been mobilized from income tax over the first two quarters of the current fiscal year which was 74.3% of the target set for the period.

The government met the target only in the collection of education service fee. According to the ministry, Rs 736.7 billion has been collected as the education service fee which is higher than the target of Rs 734.8 million set for the period.

The total revenue collection in the first half is 15.2% lower than what the government had mobilized in the same period of the previous fiscal year.

Meanwhile, slackness in the real estate sector and a bearish trend in the share market also affected the collection of capital gains tax during the period.

(With inputs from RSS)

Himal Press

Himal Press