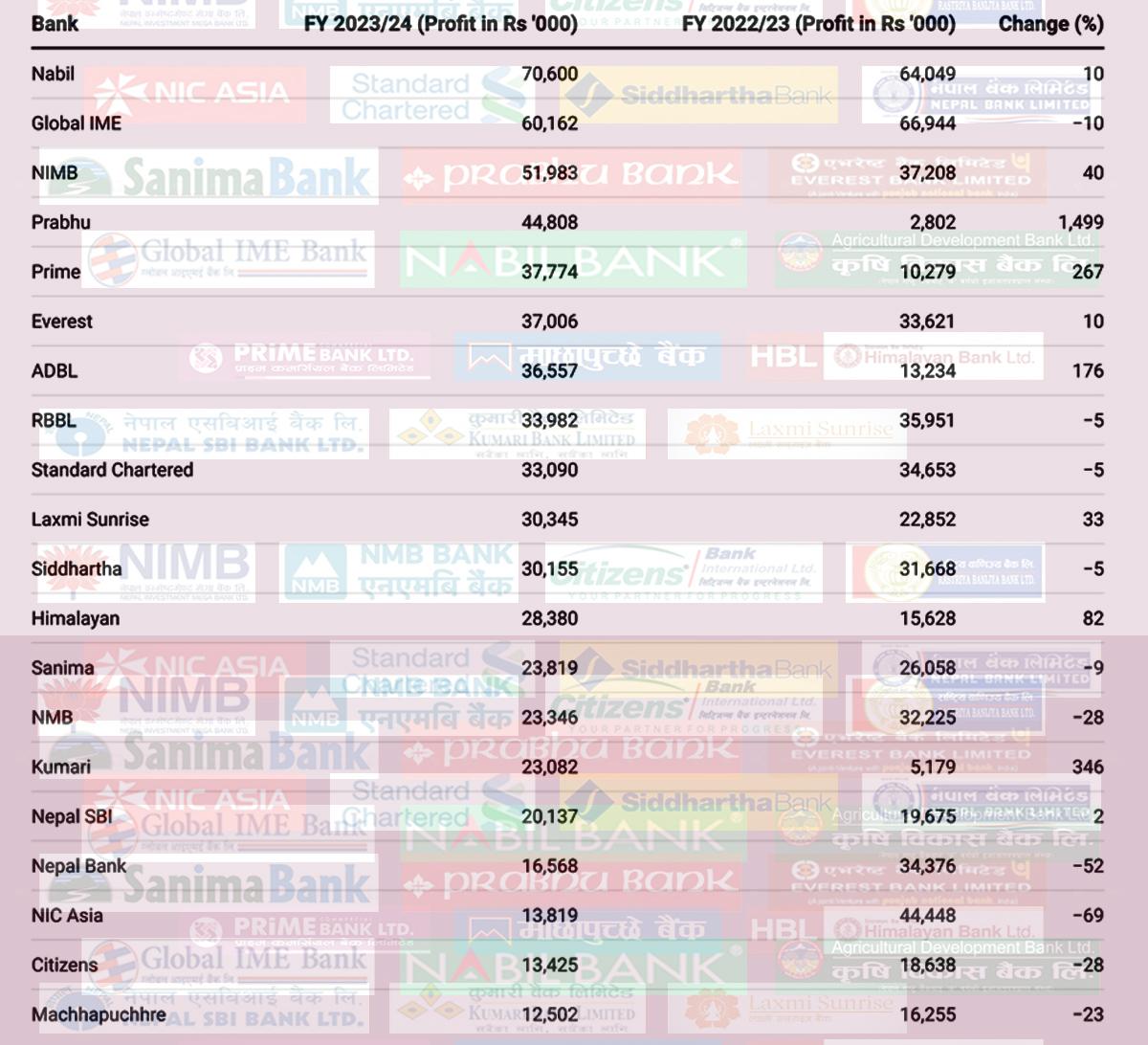

KATHMANDU: Net profit of commercial banks went up by 13.4% in fiscal year 2023/24.

Twenty commercial banks in the country earned a combined net profit of Rs 64.15 billion in 2023/24, up from Rs 56.57 billion in 2022/23. Of them, 10 reported an increase in their net profit, while the remaining 10 saw their net profit decline.

Nabil Bank, which earned a net profit of Rs 7.06 billion in 2023/24, topped the table of banks in terms of net profit, followed by Global IME (Rs 6.01 billion), Nepal Investment Mega Bank (Rs 5.19 billion), Prabhu Bank (Rs 4.48 billion) and Prime Commercial Bank (Rs 3.77 billion). Of them, Prabhu Bank recorded the biggest turnaround as its net profit increased by nearly 1500% from Rs 280.21 million in 2022/23.

NIC Asia, on the other hand, saw the biggest drop in net profit. The bank earned a net profit of Rs 1.38 billion in 2023/24, down by 68.91% compared to Rs 4.44 billion in 2022/23.

Machhapuchhre was at the bottom of the table with a net profit of Rs 1.25 billion down by 23.09% compared to 2022/23.

Among state-owned banks, Agricultural Development Bank reported a net profit growth of 176.23% to Rs 3.65 billion, while Nepal Bank Ltd and Rastriya Banijya Bank saw their net profits go down by 5.48% and 51.8% to Rs 3.39 billion and Rs 1.65 billion, respectively.

Except for one (Global IME), all seven banks that underwent mergers and acquisitions in 2022/23 posted net profit growth in the review year. Along with Global IME,

Nabil, Nepal Investment Mega, Prabhu, Himalayan, Kumari and Laxmi Sunrise started their joint operations following mergers and acquisitions in 2022/23.

Net Profits of 20 Comercial Banks Compared

Himal Press

Himal Press