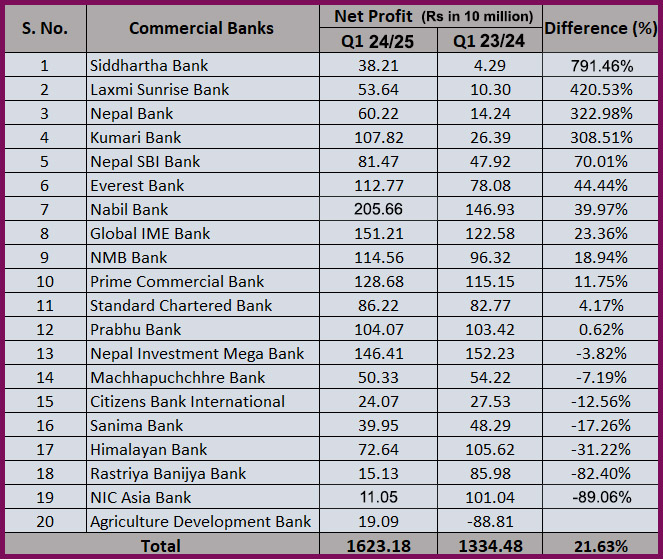

KATHMANDU: Commercial banks in the country reported a 21.63% net profit growth in the first quarter of the fiscal year 2024/25.

Unaudited financial statements for the first quarter (mid-July to mid-October) of the current fiscal year show 20 commercial banks in the country made a combined net profit of Rs 16.23 billion in the review period, up from Rs 13.34 billion in the same period of the previous fiscal year.

Nabil Bank emerged as the most profitable bank in the review period, posting a 39.97% growth in net profit to Rs 2.05 billion in the first quarter. Seven other banks – Global IME Bank, Nepal Investment Mega Bank, Prime Commercial Bank, NMB Bank, Everest Bank, Kumari Bank and Prabhu Bank – each reported net profits exceeding Rs 1 billion.

State-owned Agricultural Development Bank Ltd turned around from a Rs 888 million loss in the first quarter of the previous fiscal year to a Rs 190.9 million profit in the same period of the current fiscal year.

Siddhartha Bank recorded the highest net profit growth of 791.43%, with profits rising from Rs 42.8 million to Rs 382 million.

Seven commercial banks have reported a decline in their respective net profits. NIC Asia Bank saw the steepest decline, with profits dropping 89.06% to Rs 110.5 million from Rs 1.01 billion. Next were Rastriya Banijya Bank (-82.4%), Himalayan Bank (-31.22%), Sanima Bank (-17.27%), Citizens Bank (-12.55%), Machhapuchchhre Bank (-7.19%) and Nepal Investment Mega Bank (-3.82%).

Himal Press

Himal Press