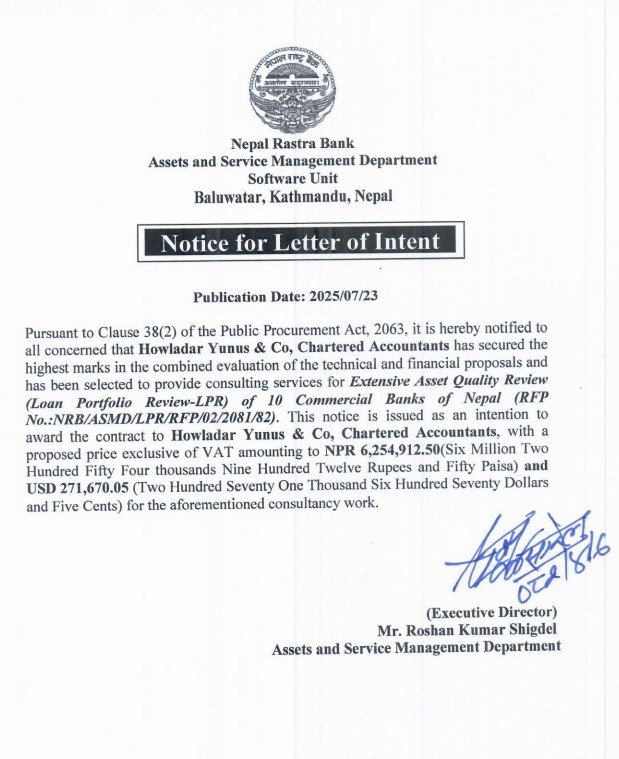

KATHMANDU: Nepal Rastra Bank (NRB) has elected Howladar Yunus & Co Chartered Accountants for loan portfolio review of 10 commercial banks.

Issuing a Notice of Letter of Intent on Wednesday, the central bank said Howladar Yunus & Co has been selected for loan portfolio review of 10 commercial banks.

Howladar Yunus & Co is one of the largest and leading chartered accountancy firms in Bangladesh. The Bangladesh firm has quoted Rs 43.74 million for the consultancy service.

“Pursuant to Clause 28(2) of the Public Procurement, Act, 2063 BS, it is hereby notified to all concerned that Howladar Yunus & Co, Chartered Accountants had secured the highest marks in the combined evaluation of the technical and financial proposals and has been selected to provide consulting services to provide consulting services for Extensive Asset Quality Rreview (Loan Portfolio Review-LPR) of 10 commercial banks of Nepal,” the notice reads.

The central bank had published a public notice, inviting international audit firms to submit their proposals for the loan portfolio review of the 10 commercial banks in December last year. This was the second bidding process after the earlier request for proposals in April last year became unsuccessful.

Although the NRB had shortlisted Deloitte Financial Advisory of the Netherlands, KPMG Assurance and Consulting Services of India, and KPMG Taseer Hadi and Company of Pakistan, as well as joint ventures between India’s PricewaterhouseCoopers and Nepal’s CSC and Company, and India’s SR Batliboi and Associates LLP and Nepal’s BK Agarwal and Company, only KPMG Assurance and Consulting Services of India submitted financial proposal. That too was rejected for exceeding the cost estimate.

The loan portfolio review of the 10 largest commercial banks was a prerequisite of the International Monetary Fund (IMF) for disbursing the Extended Credit Facility (ECF) to Nepal. The IMF wants loan portfolio review to be conducted as it suspects that banks may be underreporting their non-performing loans (NPLs).

As per the agreement with the IMF, the review process was initially scheduled to begin in the last week of April 2024 and conclude by December.

Himal Press

Himal Press