KATHMANDU: There was a sharp rise in reporting of suspicious transactions from reporting entities through the goAML system in fiscal year 2024/25.

The Financial Information Unit (FIU) submitted its Annual Report for Fiscal Year 2024/25 to Nepal Rastra Bank (NRB) Governor Dr Biswo Nath Poudel on Tuesday.

The report outlines the FIU’s policy-level and operational activities over the year, including details of financial reports received and analyzed, information disseminated to enforcement agencies, coordination at national and international levels, and the unit’s strategic priorities for the coming days.

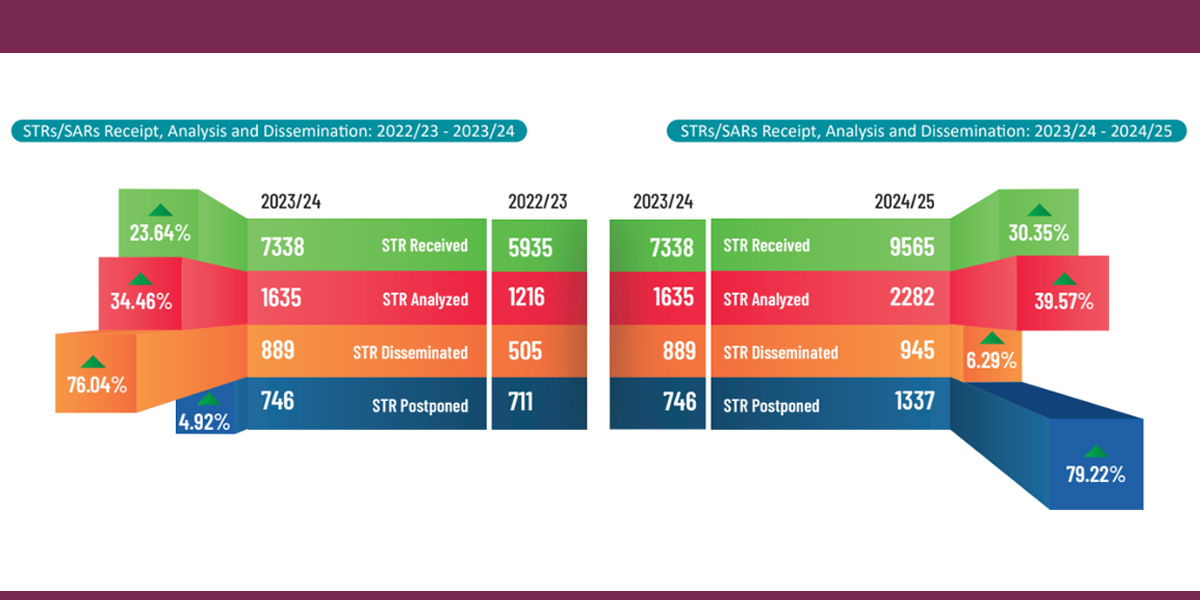

According to the report, the number of reporting entities connected to the system increased from 1,639 in 2023/24 to 3,497 in 2024/25. In the same period, the FIU received 9,565 Suspicious Transaction/Activity Reports (STRs/SARs)—a growth of nearly 30% compared to the previous year.

Analysis of received reports also rose by around 40%. Following the analysis, the FIU disseminated 945 financial intelligence reports based on STRs/SARs to the Nepal Police, the Inland Revenue Department, the Revenue Investigation Department, the Commission for the Investigation of Abuse of Authority, and other relevant law enforcement agencies. The FIU said this has directly supported the identification, investigation, and prosecution of financial crimes.

At the international level, the FIU exchanged information on 64 occasions with foreign financial intelligence units during the year.

According to the report, the FIU prepared key guidelines related to information security, confidentiality, and use, issued and updated new AML/CFT directives, and revised guidelines on suspicious and threshold transaction reporting. It also conducted year-round capacity-building, orientation, and awareness programs for reporting entities, regulatory bodies, law enforcement agencies, and other stakeholders.

Himal Press

Himal Press