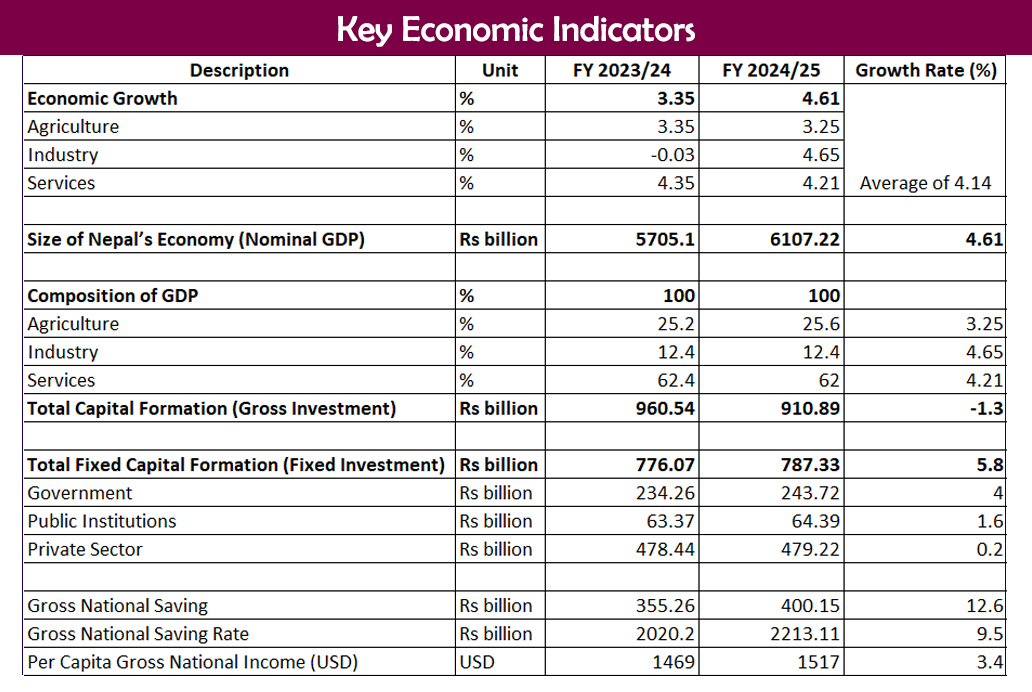

KATHMANDU: Nepal’s economy expanded by 4.61% in fiscal year 2024/25, with the size of the economy reaching Rs 61.07 trillion, according to the Annual Report for Fiscal Year 2024/25 published by the Ministry of Finance on Tuesday.

The report states that of the Rs 18.60 trillion total budget allocated for the fiscal year, Rs 15.12 trillion, or 81.33%, was spent.

According to the annual report, Rs 9.56 trillion, or 83.84% of the Rs 11.40 trillion allocated for recurrent expenditure, was utilized in the review period. Out of the Rs 3.52 trillion earmarked for capital expenditure, Rs 2.23 trillion, or 63.56%, was spent.

Similarly, Rs 3.32 trillion, or 90.58% of Rs 3.67 trillion allocated under the financial management heading, was spent during the year.

In 2024/25, the government mobilized Rs 11.96 trillion in revenue. Of this, Rs 10.49 trillion came from tax revenue, Rs 1.28 trillion from non-tax revenue and Rs 173.69 billion from other receipts, according to the report. The total revenue collection amounted to 84.28% of the Rs 14.19 trillion target set in the budget.

Nepal also received Rs 148.93 billion in foreign assistance, including Rs 23.53 billion in grants and Rs 125.40 billion in loans, during the year. According to the report, grants accounted for only 15.80% of the total foreign assistance.

The government mobilized a total of Rs 455.39 billion in public debt in the previous fiscal year. According to the report, it raised Rs 329.99 billion in domestic debt and Rs 125.40 billion in foreign debt.

Meanwhile, the government’s debt servicing cost (principal and interest) reached Rs 362.59 billion in 2024/25. It has set aside Rs 411 billion for debt servicing in the current fiscal year. Taking into account the cost and volume of debt, the current level of public debt and the trend in debt servicing costs, the report estimates that debt servicing expenses will exceed Rs 458 billion in 2026/27.

The number of taxpayers with a Permanent Account Number (PAN) increased from 6.226 million in mid-July last year to 6.999 million in mid-July this year. As of mid-July, the number of taxpayers registered for Value Added Tax (VAT) stood at 351,000, while those registered for excise duty reached 125,000.

Himal Press

Himal Press