KATHMANDU: The Federation of Nepalese Chambers of Commerce and Industry (FNCCI) has suggested that the government enable business registration via Nagarik app and offer project loans of up to Rs 10 million to promote entrepreneurship among the Gen-Z generation.

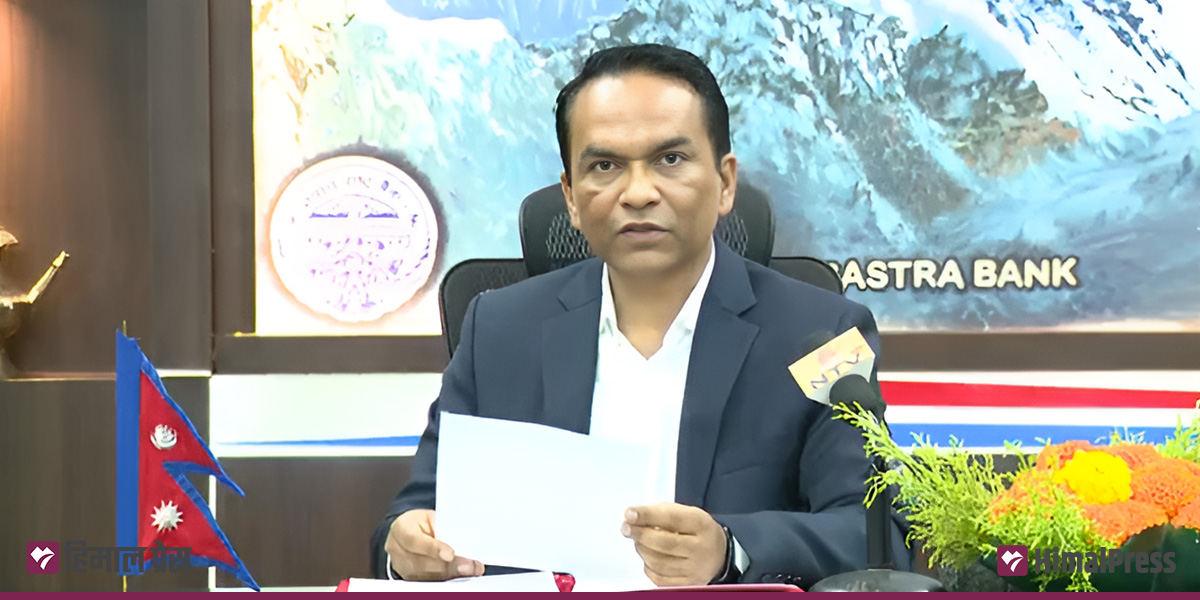

Submitting its suggestions to the Nepal Rastra Bank (NRB) for the Monetary Policy 2025/26 on Tuesday, the FNCCI called for policy reforms to address the current economic slowdown, rising financial risks and the expanding informal sector.

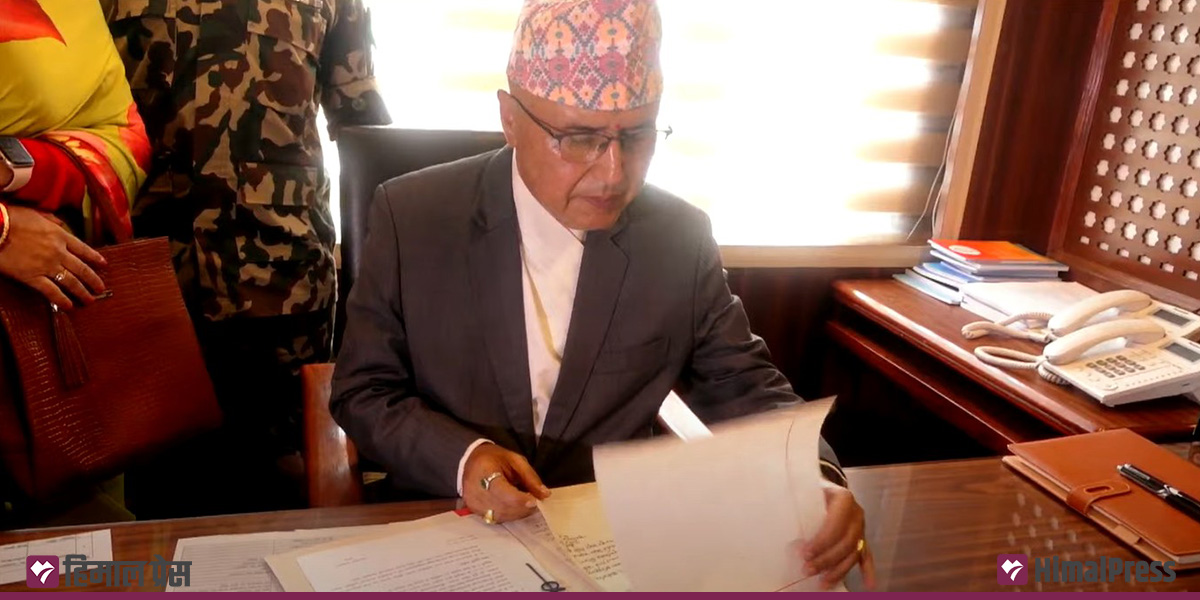

A delegation led by FNCCI Acting President Anjan Shrestha presented the suggestions during a meeting with NRB Governor Biswo Nath Poudel on Tuesday.

Speaking on the occasion, Shrestha said the monetary policy must prioritize restoring confidence in the private sector, promoting economic recovery and tackling risks related to money laundering. “Policy outcomes are being undermined by poor governance and weak infrastructure. The upcoming monetary policy should focus on plans that directly support infrastructure development,” he said.

The FNCCI has urged the government to effectively implement provisions on loan restructuring and rescheduling announced through the budget for fiscal year 2025/26. “These facilities should be made accessible to all businesses—small, medium and large,” FNCCI said. “The central bank should also bring clear and effective measures for additional working capital loans and interest waivers.”

With Nepal set to graduate from the Least Developed Country (LDC) category by 2026, FNCCI has suggested that the central bank bring policies to maintain the competitiveness of export-oriented industries, especially those that are small, home-based or women-led. “Subsidized loans of up to Rs 50 million with a maximum premium rate 2% should be introduced,” it added.

It also urged the government to implement FNCCI’s feasibility study on youth enterprise support.

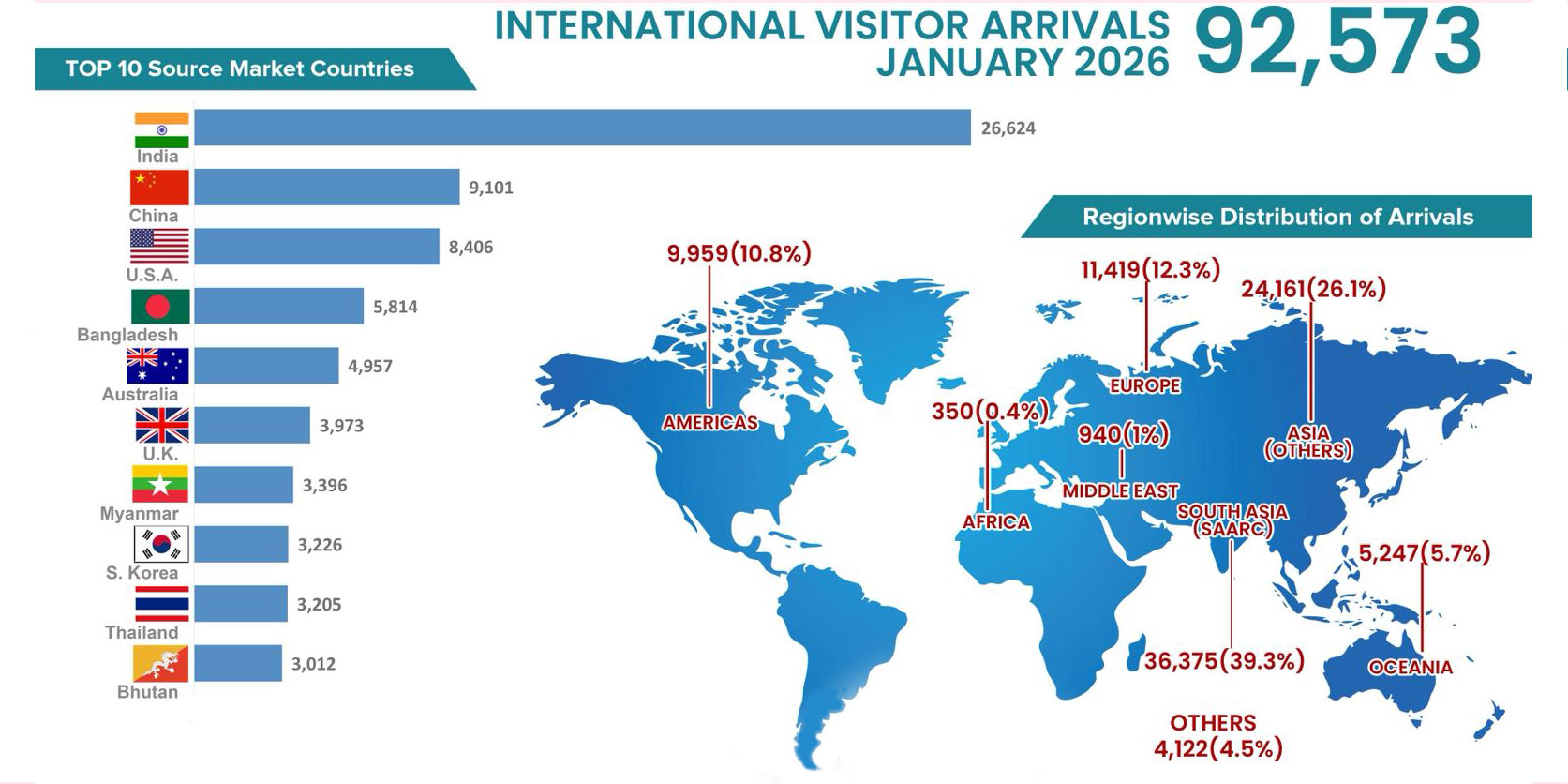

It has suggested revising the priority sector lending policy to give more weight to productive industries, tourism and infrastructure.

Stating that current regulations do not allow domestic money transfers through remittance companies, FNCCI has proposed allowing individuals to send or receive up to Rs 100,000 with valid ID through remittance service providers.

Similarly, it has urged the NRB to raise the ceiling for residential home loans to Rs 30 million from the existing Rs 20 million.

Himal Press

Himal Press