KATHMANDU: Deposits and loan investments of commercial banks went up by more than 8% over the first 11 months of the current fiscal year 2025/26.

The latest data of the Nepal Bankers’ Association shows that loan investment and deposit mobilization by Class ‘A’ banks rose by 8.23% and 8.75%, respectively, between mid-July last year and mid-June 2025.

Total credit disbursement by commercial banks reached Rs 4,910 billion in mid-June, up 8.23% from Rs 4,547 billion in mid-July last year. During this period, 18 banks managed to increase their loan investment, while two banks, NIC Asia Bank and Kumari Bank, reported a decline compared to the previous fiscal year. Global IME Bank has the highest loan disbursement of Rs 441 billion by mid-June.

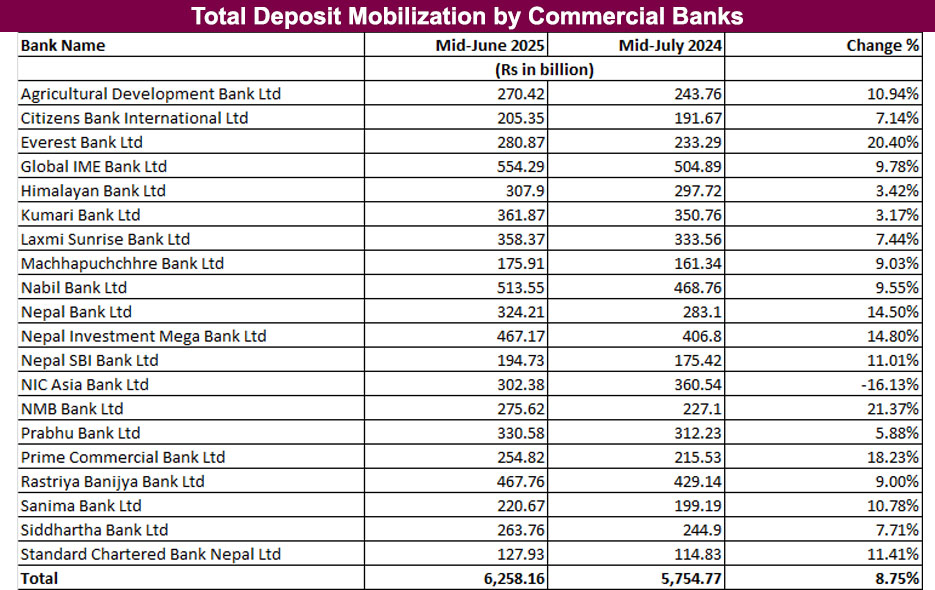

Similarly, deposit mobilization by commercial banks increased by 8.75% to Rs 6,258 over the first 11 months of the current fiscal year. Total deposit mobilization by Class ‘A’ banks stood at Rs 5,754 billion in mid-July last year.

Except for NIC Asia Bank, all the commercial banks registered growth in deposit mobilization in the review period. NMB Bank Ltd recorded the highest growth of 21.37% to Rs 275 billion. Global IME Bank, on the other hand, led the commercial banks in deposits with total deposits of Rs 554 billion in mid-June.

Himal Press

Himal Press