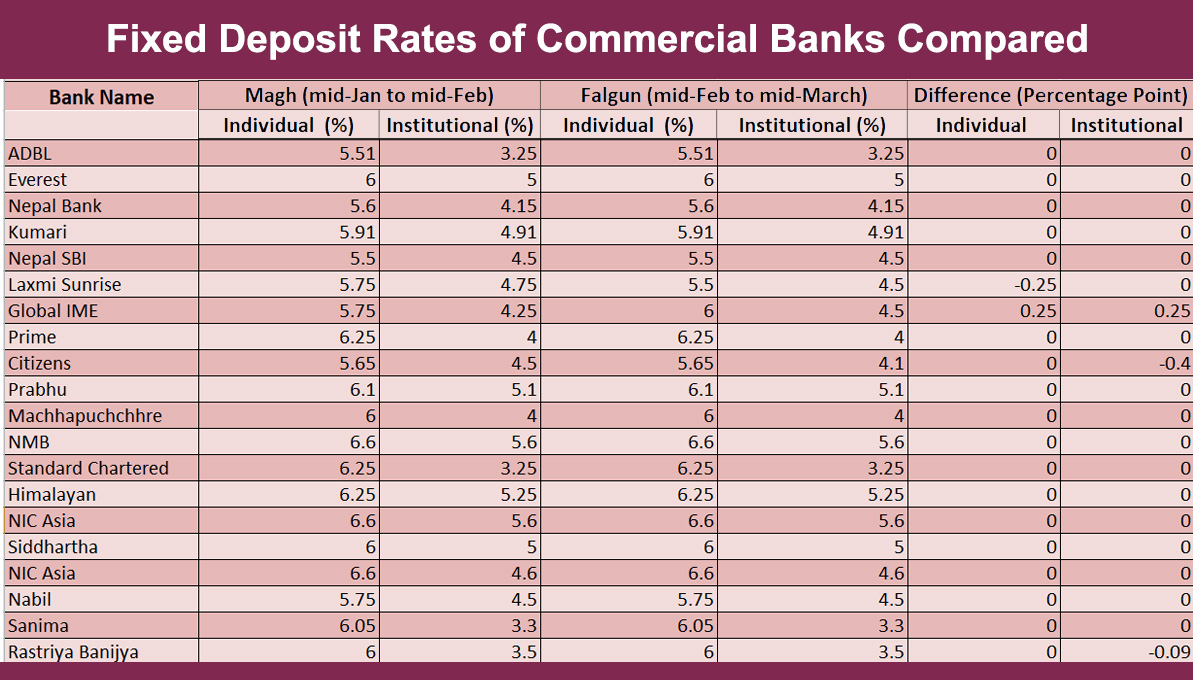

KATHMANDU: Eighteen out of 20 commercial banks have kept their interest rates unchanged for the month of Falgun (mid-February to mid-March). As a result, the average interest rate on individual fixed deposits has remained unchanged at 6.0001%.

Only two banks had changed their rates in the month of Magh (mid-January to mid-February). Fourteen banks had kept their interest rates unchanged in Poush (mid-December to mid-January), while 11 had reduced their rates in Mangsir (mid-November to mid-December). This indicates that credit demand is gradually picking up in recent months.

Laxmi Sunrise Bank has lowered its interest rate on individual fixed deposits by 0.25 percentage points to 5.5%, while Global IME Bank has raised its interest rate on individual fixed deposits by 0.25 percentage points to 6%. Global IME has also raised its interest rate on institutional fixed deposits by 0.25 percentage points, making it 4.5%.

Citizens Bank International lowered its interest rate on institutional fixed deposits by 0.4 percentage points, making it 4.1%. The bank has kept its interest rate on individual fixed deposits unchanged at 5.65%.

NIC Asia Bank is offering the highest interest rate of 6.6% on individual fixed deposits among commercial banks. Nepal Investment Mega Bank Ltd is offering a 6.5% interest rate on individual fixed deposits, while Prime Commercial Bank, Himalayan Bank Ltd, and Standard Chartered Bank have the same interest rate of 6.25% on individual fixed deposits.

Nepal SBI and Laxmi Sunrise, on the other hand, are offering the lowest interest rate of 5.5% on individual fixed deposits.

Banks have been unable to expand their credit flow in recent months due to a prolonged slowdown in economic activities. Credit demand is not picking up even though lending rates have fallen to one of the lowest levels in recent years.

Himal Press

Himal Press