KATHMANDU: Fitch has assigned Nepal a Long-Term Foreign-Currency Issuer Default Rating (IDR) of ‘BB-‘ with a stable outlook.

A ‘BB-‘ rating falls within the “non-investment grade” or “speculative” category. This suggests that the country has some vulnerabilities to economic or financial pressures but is currently able to meet its debt obligations. It indicates higher risk compared to investment-grade ratings, such as ‘BBB-‘ or above, but not as risky as lower speculative grades like ‘B’ or ‘CCC’.

The rating specifically assesses the country’s ability to repay debt denominated in foreign currencies. This type of debt is considered more challenging to manage because repayment depends on the country’s ability to earn or acquire foreign currencies.

The “Stable” outlook means that the rating agency does not anticipate significant changes (upgrades or downgrades) to the country’s creditworthiness in the near future, assuming current trends in economic and financial conditions persist.

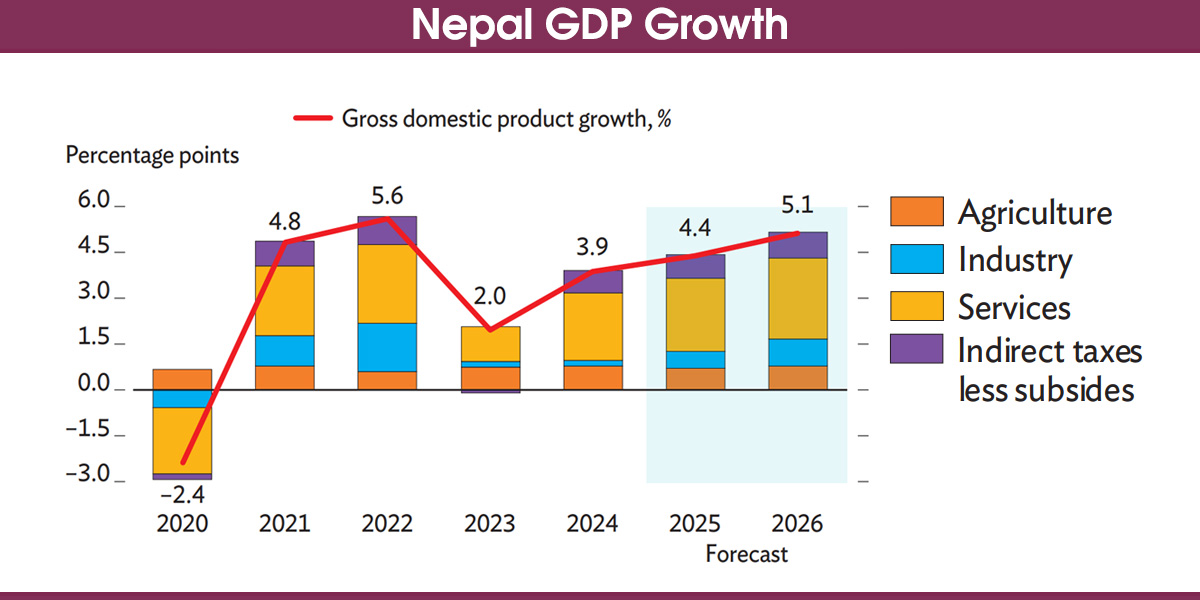

Stating that Nepal has a liquid banking sector that is funded by large remittance inflows and low policy rates that are accompanied by capital controls, Fitch said it expects Nepal to still enjoy strong availability of concessional funding after graduating from Least Developed Country Status in 2026.

Fitch has also pointed out several factors that could lead to Nepal’s degradation in rating. These include a substantial increase in the government debt/GDP ratio due to less prudent fiscal management, a material weakening of bilateral and multilateral creditor support that strains external financing and pressures foreign-exchange reserves, and a material weakening of medium-term growth prospects; for example, due to challenges in implementing development projects amid political instability.

Likewise, Fitch has said that strong, stable economic growth enabling substantial increases in GDP per capita, potentially supported by improved governance standards and regulations conducive to private and foreign investment, and a material reduction in government debt; for example, due to sustained revenue mobilization could lead to a rating upgrade for Nepal.

Himal Press

Himal Press