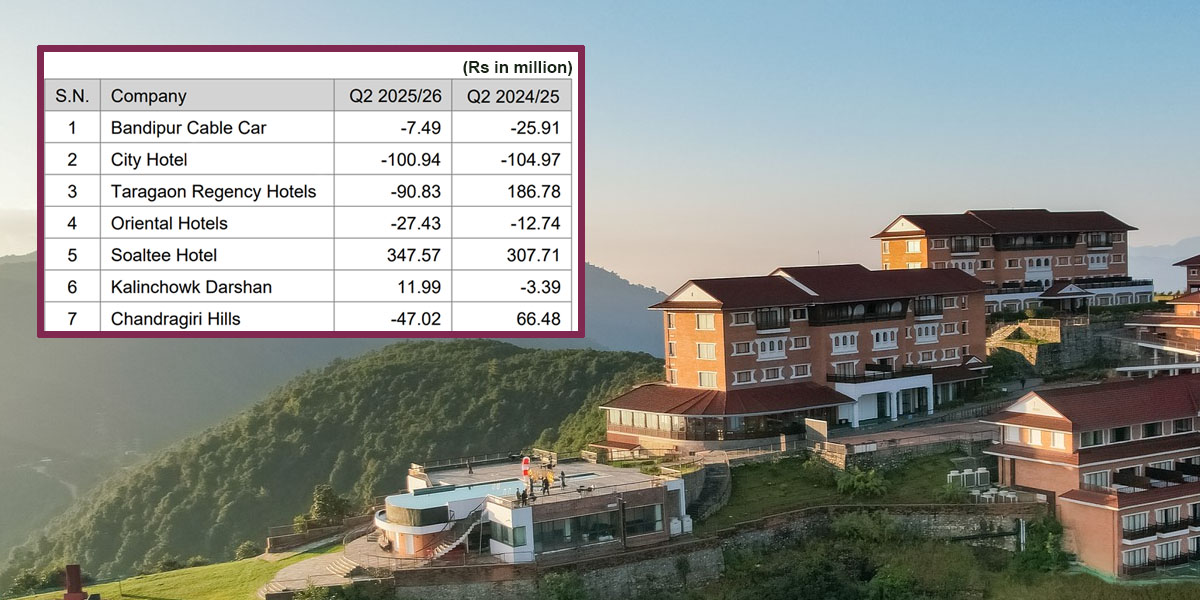

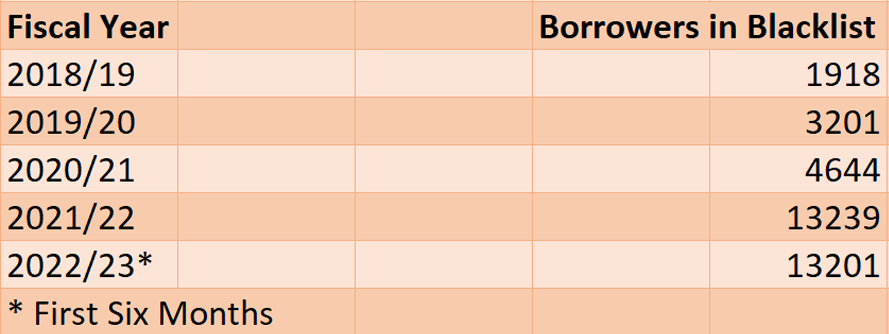

KATHMANDU: In the first six months of the current fiscal year, the Credit Information Bureau (CIB) has blacklisted 13,201 individuals for defaulting on loans. This number is equal to the number of individuals blacklisted by the CIB in the 12 months of the previous fiscal year. In fiscal year 2021/2022, a total of 13,239 individuals were blacklisted for defaulting on loans from various banks and financial institutions.

The number of individuals blacklisted by banks and financial institutions for defaulting on loans has seen a significant increase over the past four years. From 2015/2016 to 2018/2019, only 3,910 individuals were included in the CIB’s blacklist for defaulting on bank loans. However, following the outbreak of the COVID-19 pandemic, the number has grown to 3,201 in 2019/20.

Since April 2020 until the first six months of the current fiscal year, a total of 30,721 individuals have been blacklisted by the Credit Information Center (CIB) for defaulting on bank loans. This is a significant increase compared to the two-year period of 2017 and 2019, during which only 5,881 individuals were blacklisted by the center.

Experts say that the sharp increase in the number of individuals defaulting on bank loans is a concerning sign for the economy. Former banker Parshuram Kunwar Chhetri states that this trend indicates that the country’s economy is not on the right track. “It seems that the contraction of demand seen during the COVID epidemic is still continuing,” he said. “The concerned agencies should pay attention to this and make necessary policy decisions to boost the economy.” With the onset of the COVID-19 pandemic, the central bank introduced a policy that barred banks and financial institutions from auctioning off collateral pledged by borrowers for six months. Now that this period has elapsed, banks are beginning to auction off these collaterals again.

Those defaulting on loans are primarily small and medium-scale industrialists and businesspeople.

According to the CIB, those defaulting on loans are primarily small and medium-scale industrialists and businesspeople. The CIB’s blacklist does not include large-scale businesspeople and industrialists.

Small and medium-sized enterprises (SMEs) are considered the backbone of the economy, as they employ about 70% of the workforce. However, this group is often the first to be affected when problems arise in the economy, as they typically do not have large cash reserves to sustain their business for an extended period. The COVID-19 pandemic has had a particularly harsh impact on SMEs, as they have had to contend with high inflation, a lack of liquidity in the banking system, and a contraction in demand, among other challenges.

Another issue for SMEs is that they often have limited access to commercial bank loans due to factors such as lengthy loan application processes, and lack of sufficient income or collateral. This leads many medium-sized business owners to turn to cooperatives and microfinance for loans, which can be more expensive and have higher loan servicing costs.

Dinesh Shrestha, Vice President of the Federation of Nepalese Chambers of Commerce and Industry (FNCCI), states that the economy has become more volatile following the pandemic and small entrepreneurs have been greatly impacted. “Demand has decreased by 70%. In such a situation, it is impossible for industrialists to survive,” he said.

Dr Gunakar Bhatta, a spokesperson for Nepal Rastra Bank (NRB), states that the central bank has been providing concessions to the industrial sector through various policy decisions. “After the pandemic, the NRB made a dozen of decisions and gave concessions to businessmen, and some of them are still being implemented,” he said. “The facility was given because there was a slowdown in business. But loans have to be serviced after the completion of the specified period.”

According to Bhatta, banks do not have the intention to auction off collateral, but also mention that they don’t have other options.”

Reasons for blacklisting

The Credit Information Bureau (CIB) was established in the late 1980s as an agency under the central bank of Nepal. Its primary role is to maintain a list of individuals who misuse bank loans, default on loans, or commit other financial crimes. The CIB also maintains records of all loan details approved by banks or financial institutions. Individuals who fail to make contact with their bank or financial institution for 90 days, or who default on loan principal or interest payments for more than one year, are blacklisted by the CIB. The center also has the authority to blacklist borrowers who have been proven to have misused loans. Banks are required to inform the CIB if a borrower’s loan repayment period has exceeded 90 days and the loan amount is Rs 1 million or more. Microfinance institutions are required to blacklist borrowers who default on loans of Rs 500,000 or more. Borrowers who intentionally default on loans can be blacklisted regardless of the amount of debt.

Additionally, those who commit fraud using fake checks, foreign currency, credit/debit cards, etc., or who issue checks without sufficient funds in the account (check bounce) can also be blacklisted. This provision has been in place since 2018/19.

Those who are in the blacklist are not allowed to take more loans from banks and financial institutions and even renew their previous loans.